Startups live and die by how well they manage their finances. For early-stage founders and growth-stage executives alike, financial management for startups is as critical to success as building a great product or scaling the team. Many promising companies have faltered due to poor budgeting or lack of cash oversight – in fact, 29% of startups fail because they run out of money.

This statistic underscores that disciplined budgeting and cash flow planning can make the difference between a startup’s survival and collapse. Both fledgling ventures and fast-scaling companies need robust financial strategies to allocate resources wisely, plan for the future, and instill investor confidence.

A startup founder diligently reviewing financial data. Effective financial management – from budgeting to cash flow forecasting – is vital to a venture’s survival.

In this article, we examine key pillars of startup financial management: strategic budgeting, cash flow forecasting, fundraising readiness, and scenario planning for uncertainty. We also explore the benefits of leveraging outsourced CFO for startups as a cost-effective way to gain seasoned financial leadership. The goal is to provide both early-stage and growth-stage startup leaders with insights into building a solid financial foundation – and to highlight how ERB, as a trusted provider of outsourced financial strategy and operations, can support startups in these critical areas.

Strategic Budgeting: A Startup Budgeting Strategy for Growth

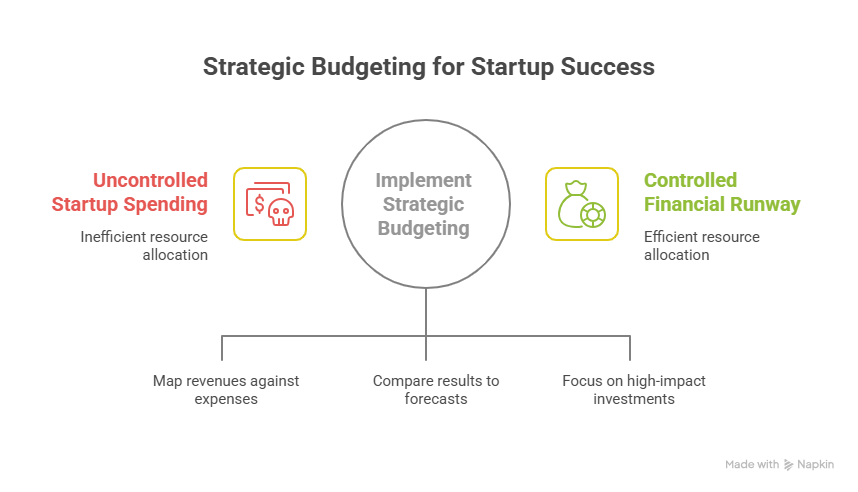

Budgeting with a strategic lens is the backbone of financial management for startups. A well-crafted startup budgeting strategy aligns a company’s spending with its business goals and stage of growth.

Early-stage startups (pre-seed through Series A) should establish a basic budget derived from a sound financial model, mapping out expected revenues (even if speculative) against all expenses.

This exercise forces founders to quantify assumptions and ensures that every dollar is allocated to the highest-priority needs (product development, customer acquisition, etc.) while conserving cash. One common mistake is overly optimistic projections leading to unrealistic budgets – instead, it’s wise to ground budgets in conservative estimates and adjust regularly as conditions change.

For growth-stage startups with significant revenue and larger teams, budgeting becomes more complex and formal. Companies post-Series A/B typically implement an FP&A (Financial Planning & Analysis) process – setting annual budgets and reviewing performance monthly or quarterly.

Regular budget reviews allow leadership to compare actual results to forecasts and investigate variances (e.g. if sales come in 20% below plan, or expenses run higher than expected).

This discipline helps catch issues early and ensures resources are reallocated efficiently to support scalable growth. Crucially, strategic budgeting also means prioritizing spend by return on investment: doubling down on high-impact investments (product improvements, key hires, marketing campaigns) while avoiding vanity expenditures that don’t drive growth.

By enforcing budgetary controls and focusing on ROI, startups can control their burn rate and extend their runway – giving themselves the breathing room to hit milestones before the next fundraise.

Cash Flow Forecasting and Management: Cash Is King

If budgeting is the roadmap, cash flow planning is the fuel gauge for a startup.

“Cash is king” might sound clichéd, but it holds true – running out of cash is one of the top reasons startups fail.

Cash flow forecasting means projecting your cash inflows and outflows over time to ensure the company stays solvent and can meet its obligations. For an early-stage company, this often boils down to monitoring burn rate (how much cash you’re spending monthly) and runway (how many months you have before the cash runs out).

Founders should track these metrics religiously. For example, if you have $500K in the bank and your burn is $50K per month, you have a 10-month runway.

It’s generally advised to maintain at least 12–18 months of runway at all times.

Enough to reach key milestones and raise the next round without desperation. Keeping a healthy runway might involve cutting non-essential costs or finding ways to bring in revenue sooner. As one Silicon Valley Bank analysis noted, startups should raise enough money to cover 12–18 months so they have time to achieve their goals before needing more capital.

For growth-stage startups, cash flow management remains critical even as revenues grow. Scaling often requires heavy reinvestment – launching new markets, hiring aggressively, ramping up marketing – which can increase burn rate. The key is to manage this deliberately and monitor cash flow closely so that growth does not outpace financial capacity. Implement rolling cash forecasts that extend 18–24 months out, updating them with real data each month. This forward-looking approach will alert you to cash shortfalls well in advance, so you can take action (e.g. raising funds or slowing spend). Healthy cash flow planning also involves maintaining a buffer for contingencies; having a few extra months of cash in reserve can be a lifesaver if sales slip or a fundraising round takes longer than expected.

Fundraising Readiness and Investor Reporting

For startups, the processes of financial management and fundraising readiness are deeply intertwined. Investors considering a startup will scrutinize its financial health and plans, so preparing for fundraising means getting your financial house in order. This starts with accurate, up-to-date financial statements and well-supported projections. Before approaching investors, founders should ensure they have a clear picture of budget versus actual spending, a credible forecast of future revenues and expenses, and a grasp of key metrics like customer acquisition cost, lifetime value, gross margins, and burn rate. Savvy investors want to see that the founding team understands its economics and has a plan for reaching the next level. Timing is also critical. Founders are wise to start preparing for the next funding round when there is still plenty of runway left – experts often recommend beginning fundraising efforts when you have around 12 months of cash runway remaining.

This avoids the “raise in desperation” scenario where you’re almost out of cash (which can force accepting poor terms or lead to failed rounds).

Instead, align each fundraise with clear milestones from your financial plan. For example, you might raise a seed round to develop an MVP and gain initial users, then a Series A to scale revenue to a certain threshold.

Tying funding needs to concrete milestones shows investors exactly how their capital will drive value creation – and it imposes financial discipline on the startup to use funds efficiently to hit those targets. Another aspect of fundraising readiness is scenario planning (covered in the next section) – being able to demonstrate how the startup would respond to different conditions. Additionally, solid investor relations and reporting practices will set a startup apart. This means establishing regular reporting (monthly or quarterly updates) to existing investors and perhaps an advisory board. Consistent financial reporting builds credibility and keeps stakeholders engaged. Many young companies lack seasoned financial leadership and struggle with investor reporting; this is where an experienced CFO or controller can make a big difference. Clear dashboards, clean financial statements, and honest variance analysis (explaining why actual results differed from budget) all signal to investors that the team is on top of the finances. Effective financial management thus directly supports fundraising: not only does it extend runway to give you more shots at raising capital, it also increases the likelihood of success by inspiring investor confidence through transparency and preparedness.

Scenario Planning: Preparing for Uncertainty

Uncertainty is a fact of life for startups, so scenario planning should be a core part of financial management. Rather than betting the company on one set of assumptions, prudent founders model multiple scenarios – typically a base case, a best case (e.g. faster growth or lower costs), and a worst case (e.g. slower sales or unexpected expenses).

By examining how each scenario would impact the income statement and cash flow, you can develop contingency plans in advance. For instance, if the worst-case scenario shows your cash running out in 6 months, you might plan aggressive cost cuts or an emergency bridge fundraise as a backup. If the best-case scenario materializes (say, revenue growth outperforms), you could have a plan for accelerating hiring or product development to capitalize on the momentum.

As one best practice, tie triggers to your scenarios – e.g. If revenue falls 30% below plan for two consecutive months, then freeze hiring and non-essential spend. This way, the team has clear guidance on when to pivot or pull back, rather than reacting in panic. CFOs and financial advisors often stress the value of these what-if analyses as a competitive edge in risk management.

In fact, many investors will explicitly ask about scenario plans during due diligence to gauge how proactively the startup manages risk.

The Outsourced CFO Advantage: Financial Leadership for Early-Stage Companies

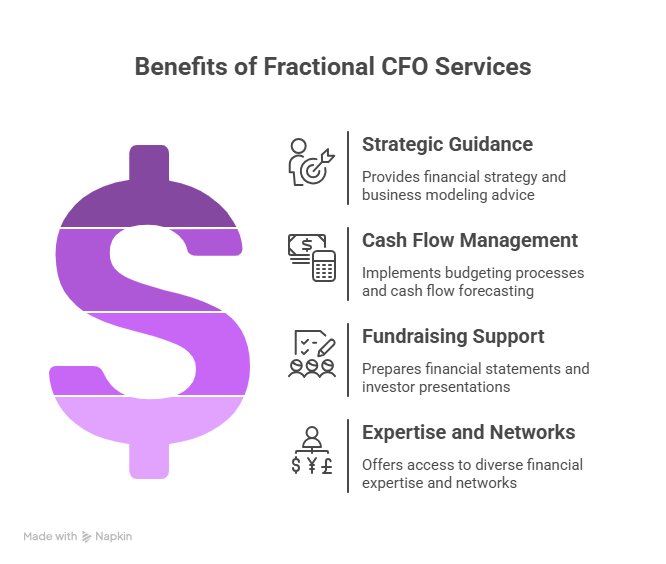

Building an in-house finance team with a veteran CFO is not always feasible in a startup’s early years – yet the need for strategic financial leadership is very real. This is where outsourced CFO services for startups come in, offering an ideal middle ground. An outsourced CFO (or fractional CFO) is a part-time, on-demand finance executive who provides high-level guidance without the full-time salary burden. For startups, this means getting access to seasoned financial expertise in a cost-efficient way. In fact, outsourced CFO services have emerged as a smart solution, offering high-level financial guidance at a fraction of the cost of a full-time hire.

These on-demand CFO partners offer flexibility and scalability – you can tap their support as needed, scaling up during critical periods (like fundraising or expansion) and scaling down when things are steady.

The benefits of engaging an outsourced CFO or financial leadership for early-stage companies are numerous:

- Strategic Guidance: A fractional CFO brings experience from guiding many companies, so they can advise on financial strategy, business modeling, and key decisions. They serve as a sounding board for founders on everything from pricing strategy to equity planning. Crucially, they help align the financial plan with the overall business strategy, ensuring that growth plans are grounded in financial reality.

- Cash Flow and Budget Management: Outsourced CFOs set up proper budgeting processes and cash flow forecasting tools. They implement best practices to control burn rate and optimize spending. For example, they might introduce rolling forecasts or budget vs. actual reviews that a first-time founder wouldn’t institute on their own. This kind of financial discipline ensures the startup’s cash flow planning stays on track and supports day-to-day decision making

- Fundraising and Investor Relations: Experienced CFOs make a big difference in fundraising readiness. They can help prepare financial statements and data rooms for due diligence, craft compelling financial projections to present to investors, and even join investor meetings to add credibility. Moreover, they often handle investor relations and board reporting, acting as a financial representative who communicates the numbers in a clear, trusted manner.

- Access to Expertise and Networks: Outsourced CFO firms typically employ professionals with wide-ranging expertise – from accounting and tax compliance to international finance. This means startups get access to a full finance department skillset without having to hire multiple people. Need to set up a U.S. entity and navigate cross-border tax laws? Or implement a SaaS revenue recognition policy? A seasoned outsourced CFO has likely done it before. These experts can also introduce startups to their network of investors, bankers, and advisors, opening doors for partnerships and funding.

- Cost Efficiency and Flexibility: For a seed-stage startup, hiring a full-time CFO (with a six-figure salary) is often overkill. Outsourcing this role saves cost by delivering only the amount of service you need – whether it’s a few hours a week or a dedicated effort during a fundraising crunch. This cost-efficiency frees up budget for other critical areas while still giving you the benefit of financial leadership. As your company grows, an outsourced CFO arrangement can scale with you, eventually transitioning to an in-house role when justified. In the meantime, you’ve saved possibly hundreds of thousands of dollars in salaries and built a solid financial foundation.

In short, an outsourced CFO provides financial leadership for early-stage companies that bridges the gap until they are ready for a full-time CFO. They bring big-company financial rigor and strategic insight, tailored to a startup’s size and culture. Many scaling startups choose this route – as one industry piece notes, “many scaling startups opt for outsourced CFO partners like ERB, which provide high-level financial guidance at a fraction of the cost of a full-time executive”. By leveraging such expertise, founders can avoid rookie mistakes, ensure compliance, and optimize their financial structure for growth.

.

ERB: A Trusted Partner in Outsourced Financial Management

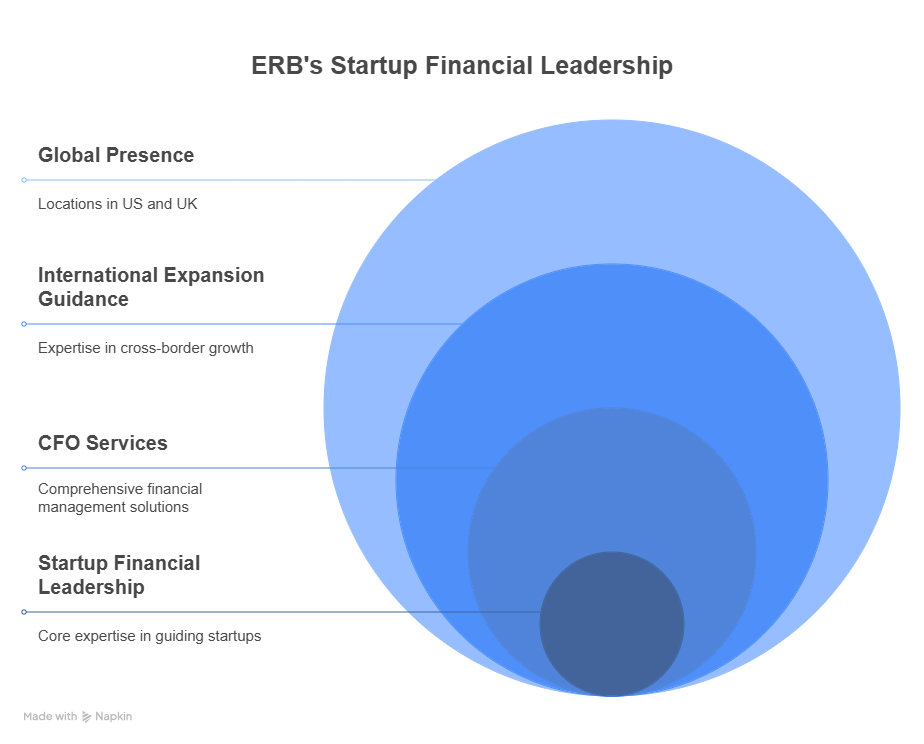

When it comes to outsourced CFO services and financial management for startups, ERB stands out as a leader and pioneer in the field. ERB brings nearly 30 years of startup-focused financial leadership, with a large team of professionals across US (New York and California) and the UK.

This global presence means ERB understands the challenges of scaling internationally. In fact, ERB specializes in guiding companies from inception through international expansion, making it an invaluable ally for startups eyeing U.S. market entry or other cross-border growth.