Many young startups have brilliant ideas but falter without a solid financial strategy.

Crafting a robust startup financial strategy is essential to beat these odds. This involves careful budgeting, runway planning, aligning finances with fundraising goals, rigorous financial modeling and scenario analysis, vigilant cash flow management, and planning for global expansion.

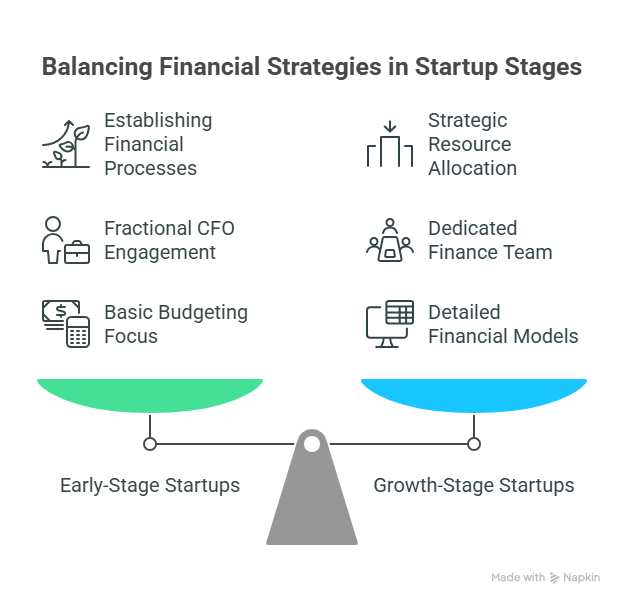

In practice, early-stage companies face different financial challenges than growth-stage ventures, requiring a tailored approach at each phase. Increasingly, founders turn to outsourced CFO services for high-level financial guidance at a fraction of the cost of a full-time hire.

The right financial partner can provide the expertise needed to build a solid financial foundation and steer startups through scaling and international growth.

Early-Stage vs. Growth-Stage Financial Needs

Startups’ financial needs evolve dramatically from the seed stage to the scale-up stage. Early-stage startups are typically focused on establishing fundamental financial processes and conserving cash. Financial leadership at this stage often centers on basic budgeting, setting up bookkeeping, and compliance with accounting and tax requirements.

It’s common to engage a fractional CFO on a part-time basis to get strategic insight without the expense of a full-time CFO. This allows early startups to implement basic accounting infrastructure, develop initial projections, and understand their unit economics while keeping burn rate low.

By contrast, in the growth stage, a startup’s financial strategy becomes more sophisticated and forward-looking. As the company gains traction (typically post-Series A and beyond), the CFO’s role expands to strategic planning and analysis. The focus shifts from simple record-keeping to optimizing resources for maximum growth while maintaining sustainable economics.

Growth-stage startups need detailed financial models, department-level budgets, and performance tracking systems. They might build an internal finance team or scale up outsourced financial support to handle complexities like multi-country operations, revenue recognition, and investor reporting.

In short, early-stage companies prioritize establishing controls and extending runway, whereas growth-stage companies emphasize strategic resource allocation and scaling efficiently.

Recognizing which stage your startup is in will inform the appropriate financial strategy and whether a part-time solution or a dedicated finance team (or partner like ERB) is needed.

Budgeting and Runway Planning

Creating and managing a budget is one of the most important practices for a startup founder.

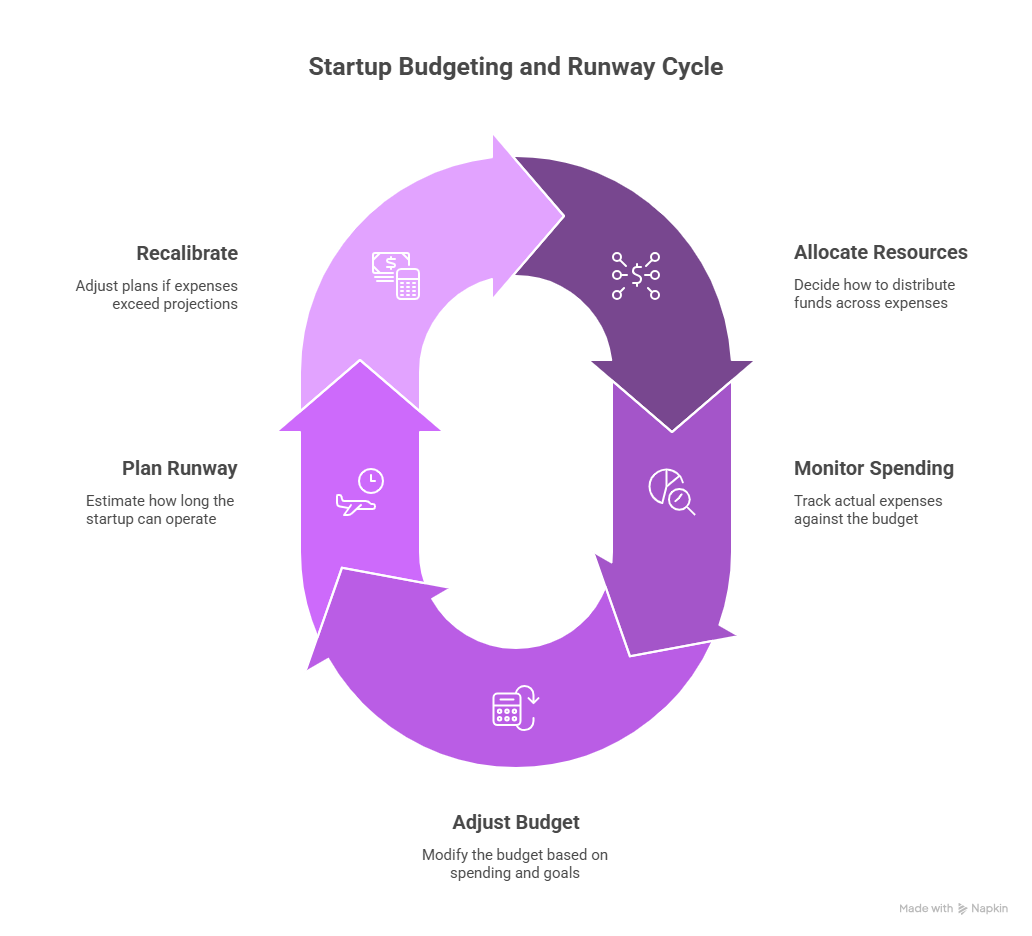

At its core, budgeting means deciding how to allocate limited resources across expenses (like hiring, product development, marketing) in line with your goals. A key outcome of good budgeting is a clear understanding of your cash runway – how many months your startup can operate before running out of cash at the current burn rate. Early-stage startups typically aim for 12–18 months of runway, but experts often recommend planning for a larger buffer of 24–36 months if possible. This cushion helps startups weather delays in product development or fundraising. Effective budget management also forces discipline: it controls the burn rate and aligns spending with company goals, ensuring that every dollar spent drives value.

Budgeting is not a one-time task but a continuous process. Founders should frequently compare actual spending against the budget and adjust as needed.

Runway planning goes hand-in-hand with budgeting – if expenses start to exceed projections or revenue is slower than expected, you must recalibrate quickly.

Seasoned CFOs advocate for flexible budgeting that can adapt to changing conditions and market surprises. In fact, thoughtful financial leaders build resilience through “appropriate runway planning and flexible budgeting approaches that can adapt to changing conditions”.

For an early-stage startup, this might mean cutting or delaying non-critical spending when funding is tight. For a growth-stage company, it could mean reallocating budget toward higher ROI activities if market opportunities shift. The goal is to always maintain enough runway to reach the next critical milestone or funding round without compromising the startup’s momentum.

Aligning Financial Strategy with Fundraising

A startup’s financial strategy should be closely aligned with its fundraising strategy. In practical terms, this means planning your spending and growth milestones around when and how you will raise your next round of capital. Every funding round – whether seed, Series A, or later – comes with investor expectations for progress (user growth, revenue, product development) that must be met with the money raised. Running out of cash too early, or conversely raising significantly more than needed, can both be detrimental. A strategic CFO helps founders develop a funding roadmap that times capital raises to business needs and market conditions. They ensure the company is raising the appropriate amount at the optimal valuation to minimize dilution while providing sufficient runway.

Crucially, this involves setting and hitting key milestones before the next raise – for example, achieving a target user base or revenue figure by the time you approach Series A investors.

In addition, strong financial leadership significantly improves investor relations and fundraising success. Investors are far more likely to fund a startup that demonstrates fiscal discipline, clear metrics, and realistic growth forecasts. By implementing proper financial controls and creating realistic financial projections, a CFO boosts investor confidence that the startup will manage new capital responsibly.

During fundraising, a CFO can prepare compelling financial decks and handle due diligence requests thoroughly – from historical financial statements to forward-looking models. This level of preparation often makes the difference between a successful fundraise and a missed opportunity.

As CFOs often note, raising money always takes longer than founders expect, so aligning your finances with the fundraising timeline is vital. By tracking cash burn and growth closely, you’ll know when to start conversations with investors so that you’re not negotiating from a position of desperation when funds run low.

With the right financial strategy, your fundraising efforts can be timed and executed to support sustained growth rather than short-term survival.

Financial Planning & Analysis (FP&A) and Scenario Modeling

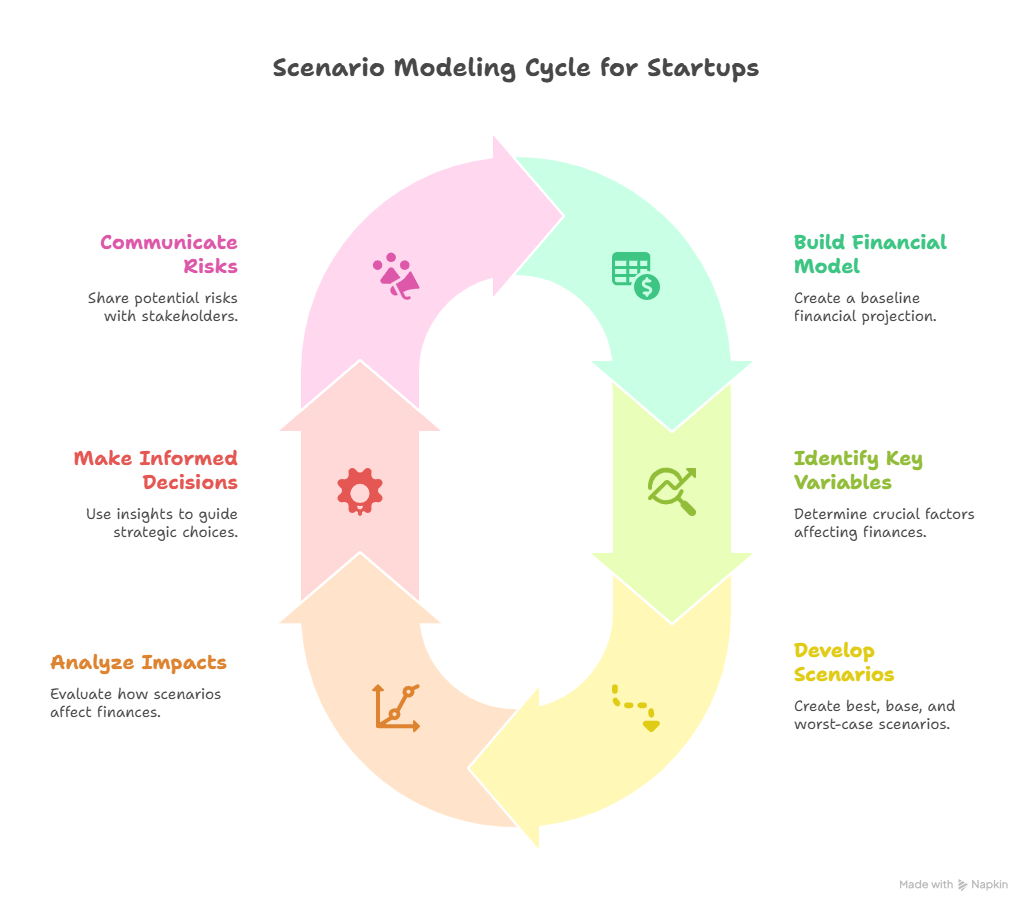

As a startup grows, financial planning and analysis (FP&A) becomes a critical function. FP&A involves building financial models, budgets, and forecasts that translate your business plan into numbers.

For a startup, a good financial model acts as a roadmap: it projects your revenues, expenses, and cash flow over the next 1–3+ years based on assumptions about your business drivers. But since the future is uncertain, leading startups don’t rely on just a single static forecast – they use scenario modeling to explore multiple outcomes. Scenario analysis is a technique within financial modeling that lets you “evaluate the possible impacts of different events on your startup”.

In practice, this means creating best-case, base-case, and worst-case versions of your financial plan (and sometimes additional scenarios for specific risks like a market downturn). By mapping out these “what if” scenarios, founders can see how changes in key variables (like hiring pace, pricing, or market expansion) would affect the company’s finances and runway.

The value of scenario modeling is that it prepares you for a range of possible futures. Done correctly, scenario analysis helps startups make informed decisions, pivot quickly when needed, and proactively communicate potential risks and opportunities to investors.

Cash Flow Management and Forecasting

“Cash is king” may be a cliché, but it’s absolutely true for startups.

- Effective cash flow planning for startups can be the difference between scaling up and shutting down.

- Cash flow management means monitoring the timing of all cash inflows and outflows – from revenues, investment, loans (inflows) to salaries, rent, vendor payments (outflows) – to ensure the company can meet its obligations at all times.

- Many startups that fail are actually profitable on paper but run out of working capital because they didn’t manage cash flow properly.

In fact, studies indicate that a large percentage of startups (over a third) experience critical cash flow crises, but with proper forecasting this risk can be more than cut in half.

Navigating Global Expansion and U.S. Market Entry

Expanding into global markets is an exciting sign of growth, but it introduces significant financial complexity.

When a startup plans a strategic global expansion, for example, entering the U.S. or European markets, the financial strategy must account for new variables.

Different countries bring different regulations, taxes, currencies, and operational costs.

There are important questions to address:

How will you handle currency exchange and international banking? What are the tax implications of selling in another country? Do you need to set up a local subsidiary or entity, and how will you manage its accounting?

A well-crafted financial strategy will incorporate these considerations so that expansion doesn’t accidentally destabilize the company’s finances.

Partnering with an Outsourced CFO for Scaling Success

Navigating the financial journey from a fledgling startup to a growing global company is challenging – but you don’t have to do it alone.

Engaging an outsourced CFO or financial consulting partner can provide exactly the expertise you need, when you need it. These professionals bring seasoned experience in financial planning, analysis, cash flow forecasting, and international expansion support, without the overhead of a full-time hire.

In fact, outsourced CFO services have emerged as a smart solution for startups to gain “high-level financial guidance at a fraction of the cost” of hiring a full-time CFO.

You get the benefit of a CFO’s strategic insight, along with a supporting team (accountants, bookkeepers, analysts), in a flexible model that scales with your company. ERB is one such trusted financial partner, with a track record spanning over 27 years of helping startups grow locally and globally.

With a large team across New York, California, and London, ERB provides 360° financial services covering everything from day-to-day bookkeeping and payroll to high-level CFO guidance.