Startup success isn’t just about innovation – it’s also about financial strategy.

This guide is aimed at early-stage and growth-stage founders/executives and will explore how outsourced CFOs (including fractional CFOs, virtual CFOs, and full-service financial operations firms) can drive strategic value in budgeting, cash flow management, modeling, investor relations, compliance, and global expansion.

Why Startups Are Turning to Outsourced CFOs

Cost-effective expertise: Hiring a full-time Chief Financial Officer (CFO) is expensive – an average in-house CFO in the U.S. costs over $200,000 per year.

Early-stage startups often can’t afford this. Outsourced CFO services (whether a part-time fractional CFO or on-demand virtual CFO) solve this problem by offering seasoned financial expertise at lower cost, letting startups pay only for the level of service they need.

These fractional CFO models allow even seed-stage companies to access CFO-level guidance without straining their runway. Flexibility and scalability: Startups face volatile growth trajectories and evolving needs. Outsourced CFO arrangements provide flexibility, scaling up or down as the business grows

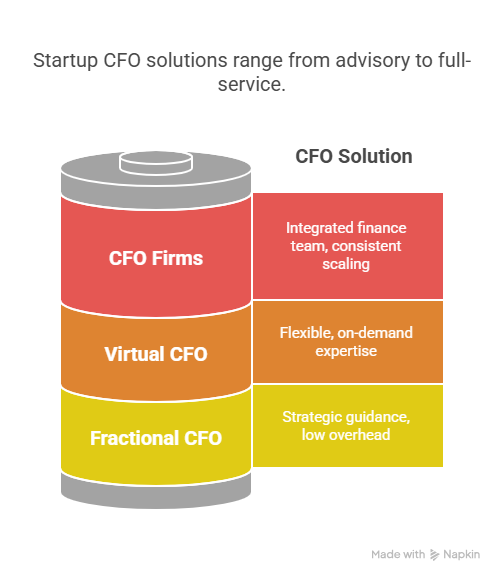

Outsourced CFO Solutions: Fractional, Virtual & Full-Service Options

Startup CFO solutions come in several flavors. It’s important to choose the model that fits your company’s stage and needs:

Fractional CFO Services: A fractional CFO is a part-time CFO who works with your startup on a retainer or hourly basis. This is ideal for early-stage companies that need strategic financial guidance but aren’t ready for a full-time CFO. The fractional CFO provides senior-level insight into financial strategy, forecasting, and decision-making without the full-time cost.

You gain an experienced advisor who can help with budgeting, fundraising prep, and financial modeling as you prepare to scale – all while keeping overhead low. For example, a seed-stage startup might hire a fractional CFO one day a week to set up financial processes and coach the founding team on key metrics.

Virtual CFO (vCFO): A virtual CFO is similar to a fractional CFO but typically implies a remote engagement (often through a firm) providing CFO services virtually. Virtual CFOs often work with multiple clients and offer flexible, on-demand support – you tap into their expertise when needed, which can be highly efficient. Many CFO service providers offer virtual CFO packages where you get a dedicated financial expert (or team) who handles strategic finance tasks via online collaboration. The benefit is access to talent from anywhere in the world, and often a broader support team behind the vCFO.

Comprehensive Financial Operations Firms (CFO Firms): For startups looking for a one-stop solution, comprehensive firms act as an outsourced finance department. These providers not only supply a CFO-level advisor, but also handle bookkeeping, accounting, payroll, tax compliance, and more. Essentially, you get an entire finance team externally. This can be powerful for growth-stage startups: all financial functions are integrated and consistent as you scale

For instance, some top firms offer services ranging from day-to-day bookkeeping and payroll management to high-level CFO strategy, tax consulting, and even investment banking advisory in fundraising – all under one roof.

Such breadth ensures that as a startup grows into multiple geographies or faces audits and investor due diligence, nothing falls through the cracks. The downside can be cost (full-service packages are pricier than a solo fractional CFO) and potentially using a larger firm may feel less personalized.

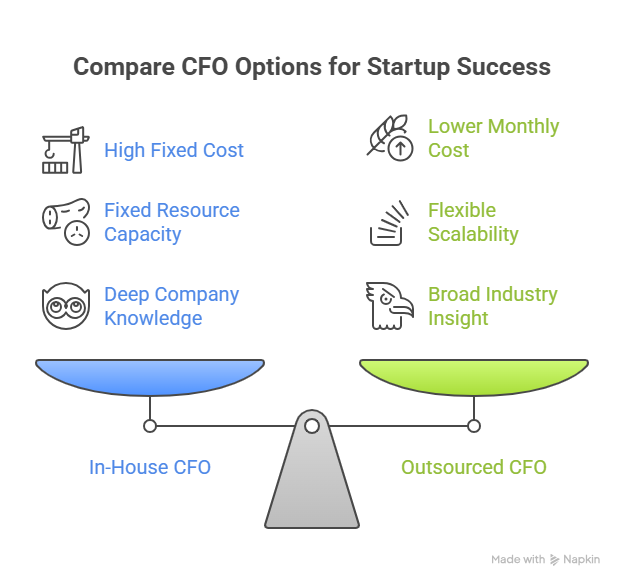

In-House vs. Outsourced CFOs: Pros and Cons

Deciding between hiring an in-house CFO or using outsourced CFO services is a crucial choice for founders. Here’s a comparison of the key pros and cons of each approach:

Cost Efficiency: In-house CFOs come with a high salary, benefits, and equity – a significant fixed cost. Outsourced CFOs offer a far cheaper alternative: startups can access top-notch financial guidance for perhaps a few thousand dollars a month instead of a six-figure salary.

Flexibility & Scalability: A full-time CFO is a fixed resource – their capacity might be underutilized in a small startup, and you’re locked into their employment. In contrast, an outsourced CFO engagement is highly flexible and customizable. You can start with a few hours a week and ramp up as complexity grows.

Need extra help during a fundraising round or an expansion project? Your fractional CFO can scale up their involvement, then scale down afterward. This elasticity lets you match financial leadership to your stage. (Advantage: Outsourced CFO) However, note that part-time CFOs split their time with other clients, so you must coordinate schedules and may not get instant full-time attention.

Expertise and Perspective: A great CFO brings experience and strategic insight. An in-house CFO will eventually develop deep company-specific knowledge by being immersed daily in your business, which can be invaluable for nuanced internal decisions.

The Strategic Value of CFO Services for Startups

A skilled CFO (whether in-house or outsourced) does far more than bookkeeping. They act as a strategic financial partner, driving planning and ensuring the company’s finances support its growth. Key areas where CFO expertise adds value include:

Budgeting & Financial Planning: A CFO leads the creation of realistic budgets and financial plans that align with your startup’s strategy. They help founders set revenue targets and expense budgets grounded in data, not wishful thinking. By building financial models and forecasts, the CFO quantifies what needs to happen for the business to succeed.

Crucially, budget management keeps your burn rate under control and ensures you allocate cash to the highest-priority activities. This disciplined planning prevents the common mistake of overly optimistic projections that later lead to cash crunches. In short, CFO-driven budgeting gives your startup a roadmap for spending in line with your goals.

Cash Flow Management: Cash is king for startups. A CFO implements systems to track cash inflows and outflows and projects your cash runway month by month. They monitor cash burn and identify potential shortfalls early, so you can make adjustments before it’s too late.

Effective cash flow management means optimizing payment cycles, managing vendor terms, and timing expenses or investments prudently. Poor cash flow management is the #1 reason startups fail.

CFO oversight ensures your company doesn’t run out of money unexpectedly. For example, an outsourced CFO will continuously forecast your cash runway and advise when to cut costs or raise funds to maintain a healthy cushion. This vigilance is vital to keep the business solvent and ready to seize opportunities.

Financial Modeling & Scenario Planning: Startups operate under uncertainty, so a CFO helps model different scenarios to inform decision-making. By building financial models that reflect various growth rates, pricing strategies, or funding outcomes, the CFO enables you to see the potential impacts on revenue, profitability, and runway. This strategic financial planning allows the team to prepare contingency plans.

It also supports strategic financial planning for startups by aligning financial projections with business milestones. A robust model is a tool for both internal planning and for demonstrating to investors that you have a clear grasp of your financial trajectory.

Fundraising & Investor Relations: Whether pitching angels or negotiating a Series B, having CFO expertise on hand is a game-changer. CFOs play a key role in strategic fundraising support – they prepare polished financial statements, metrics, and forecasts to include in your pitch decks.

They can help craft the story of how capital infusion will be used and what milestones it will unlock. An outsourced CFO often has experience dealing with investors and can even join important calls or meetings to boost credibility. They act as a mediator and translator between the startup and investors, ensuring information is conveyed honestly and effectively.

CFOs also guide you on how much to raise and when, aligning fundraising rounds with financial needs and market conditions. Crucially, they assist with due diligence – organizing financial data and documentation so that potential investors get confidence from your clean books.

All this improves your odds of securing funding on good terms. Post-fundraise, a CFO manages investor relations by providing regular financial reports and performance updates, keeping stakeholders informed and confident.

Compliance & Risk Management: Startups can move fast, but they can’t ignore compliance (taxes, financial regulations, reporting standards) without risking fines or legal issues. CFO services ensure your accounting practices and financial reports comply with relevant standards and laws.

This includes setting up proper bookkeeping, overseeing annual audits, tax filings, and complying with revenue recognition rules, etc. An outsourced CFO firm often has specialists to handle multi-country tax compliance and regulatory filings if you operate globally. Additionally, a CFO implements risk management strategies – identifying financial risks (like currency fluctuations, cost overruns, or economic downturn impacts) and devising mitigation plans.

They ensure the company has adequate insurance, internal controls to prevent fraud, and contingency funds for emergencies. By mitigating financial risks and keeping the startup compliant, the CFO protects the company’s longevity and reputation.

Global Expansion Support: When a startup expands to new markets (e.g. entering the U.S.), the financial complexity spikes. CFOs provide critical guidance in navigating international growth. They serve as the focal point for global finance activities – handling multi-currency accounting, setting up foreign subsidiaries or bank accounts, and ensuring transfer pricing compliance between entities.

A CFO experienced in global expansion will know how to manage foreign tax compliance and reporting in each country, keeping the startup on the right side of local laws. For example, they’ll oversee registration for VAT/GST where required, handle international payroll nuances, and make sure consolidation of global financials is accurate. Outsourced CFO firms often have global financial compliance expertise, executing reporting and tax filings across countries to reduce legal risk and prepare the startup for global scale.

In short, a CFO smooths the financial ops of going international – ensuring that rapid global growth doesn’t turn into a financial control nightmare.