Global expansion into the U.S. offers immense opportunities, but requires careful navigation of legal and financial steps. Expanding a startup into the U.S. market is an exciting milestone for founders. The U.S. offers access to a huge customer base and deep pools of venture capital, but it also presents new legal and operational challenges. A proven path for global startups is to open a U.S. subsidiary as a C-Corporation (C-Corp). In particular, many companies choose to incorporate in Delaware, though California and New York are also popular for those with significant operations in those states. This article outlines the key steps to establish a U.S. subsidiary, the benefits of the C-Corp structure, considerations for Delaware vs. California vs. New York, and how partnering with an experienced financial services firm like ERB can streamline your U.S. expansion.

Key Steps to Launching a U.S. C-Corp Subsidiary

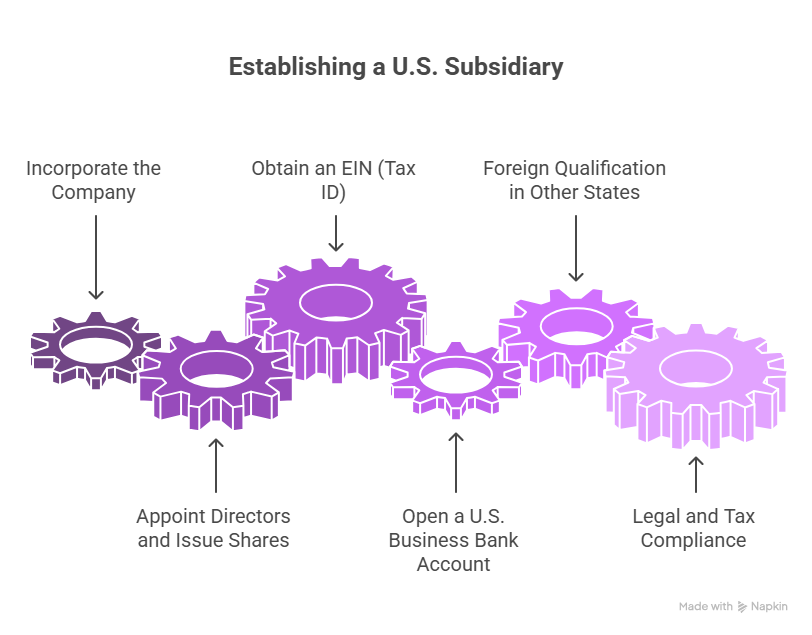

Establishing a U.S. subsidiary involves several important steps to ensure the new entity is properly formed, registered, and ready to do business:

Incorporate the Company: Begin by choosing a state and filing a Certificate of Incorporation (also called Articles of Incorporation) in that state.

Delaware is the most common choice for startup incorporations due to its business-friendly laws, but you might choose California or New York if most of your operations will be there. This filing legally creates your U.S. corporation as a separate entity (usually wholly owned by the foreign parent company). You will also need to appoint a registered agent in the state and prepare corporate bylaws and board resolutions as part of the setup.

Appoint Directors and Issue Shares: Decide on an initial board of directors for the subsidiary and appoint officers (e.g. President, Treasurer, Secretary). Then issue all the shares of the new corporation to your parent company to formally establish the parent-subsidiary ownership relationship.

In many cases the parent company will own 100% of the shares, giving it complete control over the subsidiary’s activities.

Obtain an EIN (Tax ID): Apply for an Employer Identification Number (EIN) from the U.S. Internal Revenue Service. The EIN is a tax ID for the company and is required to pay taxes, hire employees, and open a bank account.

If the company’s authorized person doesn’t have a U.S. Social Security Number, you can still obtain an EIN by submitting Form SS-4 via mail or fax. Note: without a U.S. person as a signatory, the EIN issuance can take a few weeks, so plan accordingly. The EIN confirmation letter will be needed by banks when you later set up an account

Open a U.S. Business Bank Account: With your incorporation documents and EIN in hand, you can open a bank account for the subsidiary. This is crucial for handling local revenues, expenses, and payroll. Be aware that some banks require an in-person meeting with a company officer to open the account.

If visiting a U.S. bank is difficult, there are also fintech and online banking solutions that cater to startups. Establishing a U.S. bank account may take a couple of weeks, so it’s wise to start this process early.

Having local banking in place will also facilitate setting up payroll and collecting U.S. customer payments.

Foreign Qualification in Other States: If you incorporated in one state (say Delaware) but will have a physical office or employees in another state (e.g. California or New York), you must register as a foreign corporation in those states.

“Foreign” in this context means an out-of-state company. This involves filing a short registration and paying a fee in each state where you will actually do business. For example, a Delaware corporation operating in California needs to file a foreign qualification in California. This step ensures you are legally compliant and able to pay state taxes and other obligations in each state of operation.

Legal and Tax Compliance: After formation, ensure you meet ongoing compliance requirements. This includes filing any required initial reports or statements of information in the state of incorporation, obtaining any necessary business licenses or permits (which can be state- or city-specific), and adhering to annual report and franchise tax filings. For instance, Delaware requires an annual franchise tax report, and California requires a Statement of Information filing each year. You’ll also need to register for federal, state, and local taxes as applicable (e.g. corporate income tax, sales tax if relevant, and payroll taxes once you hire employees). Setting up an accounting system at this stage is highly recommended to track the subsidiary’s finances separately from the parent.

Following these steps establishes a U.S. corporate foothold for your startup. With the basic entity, tax ID, bank account, and compliance checks in place, you’ll be ready to operate in the U.S. market. As a side note, forming a subsidiary (as opposed to a branch office) carries distinct advantages for foreign companies: it limits liability to the U.S. entity and prevents legal/tax liabilities from automatically flowing to the foreign parent, it is often more tax-efficient (avoiding the IRS “branch profits tax”), and it makes practical matters like opening bank accounts and hiring U.S. employees much easier.

Why a C-Corp? Benefits for Startups

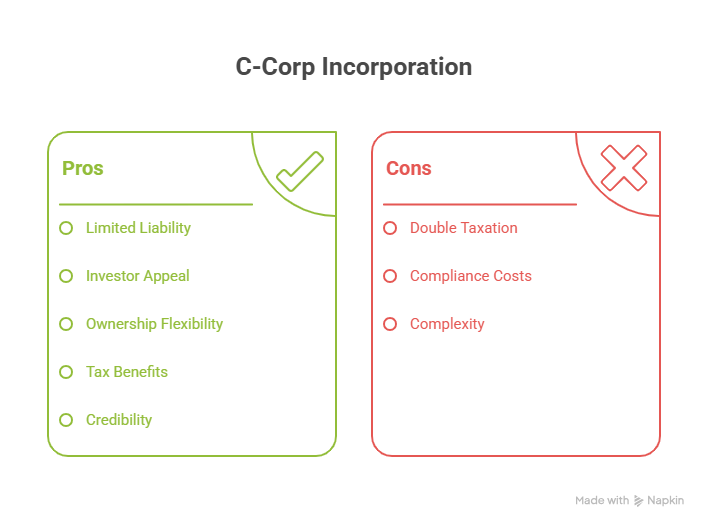

In the U.S., a C-Corporation is the gold standard for high-growth startups. If your goal is to raise capital from American investors or venture capital funds, a C-Corp (especially a Delaware C-Corp) is usually the way to go. Key benefits of incorporating as a C-Corp include:

- Limited Liability & Separate Taxation: A C-Corp is a separate legal entity that shields its shareholders (including the parent company) from business liabilities. Neither the founders nor the foreign parent are personally responsible for the debts of the corporation – they can lose at most what they invested.

Unlike pass-through entities, a C-Corp pays its own U.S. taxes, which means the foreign parent company generally won’t be subject to U.S. tax filings on the subsidiary’s income. This separation avoids the complexity of “branch” taxation and silos the U.S. tax obligations within the subsidiary.

- Investor Appeal and Fundraising: C-Corps allow issuance of stock (shares), including preferred shares, and stock options for employees. This corporate structure is what venture capitalists prefer – in fact, many VC firms and institutional investors will only invest in C-Corps, not LLCs or other entities.

The ability to grant stock options is crucial for startups to attract talent, and the standardized Delaware corporate laws give investors confidence. As a result, incorporating as a C-Corp dramatically expands your fundraising potential in the U.S. startup ecosystem.

- Ownership and Exit Flexibility: C-Corps place no restrictions on who can be a shareholder. Individuals or entities from any country can hold shares, and there’s no cap on the number of shareholders.

(in contrast, an S-Corp is limited and cannot have foreign owners). This flexibility is important for a global startup. Additionally, C-Corps are ideal if you ever plan an IPO or acquisition – the process of selling stock or transferring ownership is much smoother compared to LLCs

The C-Corp structure also has perpetual existence, continuing even if founders or owners change.

- Favorable Tax Treatment for Growth: While C-Corps do face corporate taxes, the U.S. federal corporate tax rate (21%) is straightforward, and Delaware in particular offers significant state tax advantages. If your Delaware corporation’s operations are outside Delaware, it does not pay Delaware state corporate income tax.

Delaware also has no sales tax on intangible goods and no franchise tax on small, early-stage companies beyond a modest annual fee.

Moreover, certain U.S. tax provisions (like the Qualified Small Business Stock exclusion) can benefit C-Corp shareholders after holding stock for five years, potentially making exits more lucrative. In short, the C-Corp can be very efficient for a startup that reinvests earnings for growth.

- Credibility and Governance: Having a U.S. C-Corp signals commitment to the U.S. market and can boost your credibility with customers and partners. Delaware C-Corps, in particular, are often seen as a hallmark of a serious startup. The governance structure of a corporation (with a board of directors, officers, and formal bylaws) might seem bureaucratic to a small team, but it actually helps instill discipline and clarity as you grow. Plus, Delaware’s well-developed corporate law system provides predictability – there’s a whole body of case law and even a special court (the Court of Chancery) dedicated to business disputes, which means legal issues can be resolved efficiently and consistently.

Delaware vs. California vs. New York: Where Should You Incorporate?

One of the first decisions is choosing the state for your U.S. subsidiary. Delaware is renowned among startups, but if your operations will be centered in California or New York, those states enter the discussion. Each jurisdiction has its considerations:

Delaware – Startup-Friendly and Investor-Preferred

Delaware is often the default choice for incorporation. This small state is famous for its pro-business environment and is home to the vast majority of U.S. tech startups’ legal entities. What makes Delaware so popular? For one, it has a highly developed and predictable corporate legal system – the Delaware Court of Chancery and state laws are considered the “gold standard” for corporate governance.

This predictability is comforting to investors and founders alike, as it reduces uncertainties in disputes. Delaware also offers privacy (you don’t need to list officer or director names in public filings).

and efficient administration (often you can form a company in Delaware in one day). Importantly, tax considerations play a role: Delaware does not levy state corporate income tax on companies that operate outside Delaware.

That means if your office and revenue are in other states, you only pay those states’ taxes and owe Delaware just a relatively small franchise tax and annual report fee. The minimum Delaware franchise tax for a small corporation is around $225 per year, which is quite affordable for early-stage companies. All these factors, plus a reputation that venture capitalists “expect” a Delaware C-Corp, make it a logical choice to attract U.S. investors.

Even many California and New York based startups opt for Delaware incorporation to leverage these advantages.

That said, incorporating in Delaware does mean registering as a foreign entity in whichever state you actually operate in. So if your team is on the ground in California or New York, you’ll end up dealing with those states’ regulations and taxes in addition to Delaware’s. This is common and perfectly manageable with the right guidance, but it’s worth noting you could have slightly higher admin costs (for example, paying annual fees in two states).

For most high-growth startups, the benefits outweigh the extra filings.

California – Local Advantage and West Coast Presence

If your U.S. expansion is mainly centered in California (for example, setting up in Silicon Valley or Los Angeles), you might consider incorporating the subsidiary in California or at least you will need to register to do business there. California offers the benefit of consolidating your compliance – a company incorporated and operating in California only deals with California’s requirements. This can simplify things if all your offices, employees, and revenue will be in-state.

Local incorporation can also signal commitment to the California market; some local investors and partners may appreciate seeing a California corporation as it shows you’re firmly planting roots there.

Moreover, being in California gives you direct access to one of the world’s most vibrant startup ecosystems – proximity to Silicon Valley’s venture capital, talent pool, and networks can be invaluable.

. However, California’s regulatory environment is known to be less forgiving on businesses than Delaware’s. All California corporations (and foreign corporations registered there) must pay a minimum franchise tax of $800 per year regardless of income.

California also imposes state corporate income tax on profits earned in the state. The state’s laws can be stricter in areas like shareholder rights – for example, California law provides strong protections for minority shareholders and requires larger boards if you have many shareholders.

Compliance paperwork (like the annual Statement of Information) will list your directors/officers publicly, as California is less private than Delaware.

Additionally, certain business regulations (environmental, labor, privacy, etc.) are tougher in California, which could mean more overhead to stay compliant.

None of these are deal-breakers, but they are factors to weigh. Many startups still incorporate in Delaware and then register in California as a foreign corporation, which is a common strategy to get the best of both worlds – Delaware’s legal benefits and California’s local presence.

New York – Strong Legal Protections and Market Credibility

New York is another major business hub that some startups consider for incorporation. New York state offers a well-developed legal system and robust protections for businesses. Its courts (particularly the Commercial Division in NYC) are respected for fair and sophisticated handling of business disputes.

Incorporating in New York might make sense if your core market and operations will be in New York City or the East Coast. It can simplify logistics and resonate with local customers to be a New York company. New York also provides solid liability protection and allows flexible arrangements in corporate governance similar to Delaware in many respects.

On the downside, New York has a couple of quirks. Notably, New York has a unique publication requirement: new business entities (LLCs, and in some cases corporations) must publish a notice of formation in two local newspapers for six weeks.

This antiquated rule can cost several thousand dollars, especially in NYC, and is an extra hoop to jump through when forming in New York. Additionally, New York corporations are subject to state taxes on their income (New York state and potentially New York City taxes if you operate in NYC). Unlike Delaware, which spares out-of-state income from taxation, a New York corporation will pay taxes on its global income to New York, potentially increasing your tax burden.

If you incorporate in Delaware and just register in New York as needed, you might avoid some of those taxes (you’d only pay New York tax on in-state activity). For this reason, many startups with NY presence still prefer Delaware as the home state. In summary, Delaware remains the top choice for a U.S. subsidiary in most cases due to its investor appeal and friendly laws. But if your startup will have a heavy presence in California or New York, it’s wise to account for those local requirements. Often the solution is to incorporate in Delaware and register in the other state of operations – this way you gain Delaware’s advantages while meeting all local obligations. Each situation is different, so consult with legal counsel on the optimal structure for your expansion.

Outsourced Financial & CFO Services: Accelerating U.S. Expansion with ERB

Launching a subsidiary is only the first step – next comes actually running the business in the U.S. with sound finances and compliance. Many startups find it challenging to handle U.S. financial operations remotely or with a small team. This is where a strategic partner like ERB can be invaluable. ERB is an outsourced financial services firm specializing in helping startups (particularly Israeli and global startups) manage their finances as they scale internationally.

In fact, ERB has been a leader in startup financial services for over 27 years, with a large team of experts and offices in New York, California, and London.

By engaging an outsourced CFO and finance team, you get seasoned guidance at a fraction of the cost of hiring full-time staff, and you gain the processes needed to satisfy investors and regulators. How can ERB support your U.S. expansion? Here are some of the key services and benefits ERB provides to startup founders:

Entity Setup and Bank Account Opening: Navigating the U.S. administrative maze is much easier with local expertise. ERB assists companies in registering and setting up U.S. entities and can coordinate the paperwork for Delaware incorporation or other states.

Crucially, ERB’s U.S. presence helps in opening bank accounts and establishing the necessary financial infrastructure quickly. With on-the-ground teams in New York and California, ERB can facilitate meetings with banking partners or recommend fintech solutions, ensuring your subsidiary is financially operational as soon as possible.

Financial Planning and Investor-Ready Business Plans: A solid business plan and financial model are essential for both strategic decision-making and fundraising. ERB’s CFO consultants work with you to prepare investor-ready business plans and financial projections that meet U.S. investor expectations.

Whether you need a five-year forecast for a venture capital pitch or a plan to present to U.S. immigration authorities for a founder visa, ERB has the expertise to craft detailed, credible plans. This includes building budgets and performing analysis like Budget vs. Actual tracking to keep your startup on course financially.

Implementing Payroll: Hiring employees in the U.S. means handling payroll taxes, withholdings, and labor law compliance – which can be daunting for a foreign company. ERB offers full payroll setup and management services.

They will implement payroll systems that pay your U.S. team on time and in accordance with federal/state tax regulations, and can administer benefits and insurance. This ensures your U.S. staff are taken care of and that you remain compliant with IRS and state employment filings from day one.

Financial Controls and Compliance: As your U.S. operations grow, maintaining control over finances is critical. ERB provides controllership and accounting services to establish strong financial controls, so that every expense is tracked and every invoice accounted for. They handle bookkeeping, multi-currency accounting, and reporting to tax authorities, acting as your U.S. finance department.

Ongoing CFO Advisory and Strategic Guidance: Perhaps most importantly, ERB serves as an ongoing strategic financial advisor. You get access to experienced CFO-level insight to guide budgeting, fundraising strategy, and efficient growth. ERB’s team has steered companies from seed stage through international expansion, so they can mentor you on financial best practices and investor relations. They excel in high-level planning – ensuring you build a solid financial foundation for your U.S. entity and helping adjust the strategy as market conditions evolve.

This on-demand expertise is like having a seasoned CFO on your team, without the full-time overhead. It’s especially valuable when negotiating term sheets with U.S. investors or evaluating financial implications of business decisions in the new market.

An outsourced CFO can provide expert financial oversight, allowing startup founders to focus on product and growth. By outsourcing these functions to ERB, startup founders free up time and gain peace of mind. You can focus on innovation and scaling your product, while ERB’s professionals handle the critical financial operations in the background. This includes everything from routine bookkeeping and payroll to preparing board-ready financial reports and investor updates. The result is a leaner expansion process: you avoid costly mistakes, remain compliant with U.S. laws, and demonstrate financial maturity to investors and partners. It’s no surprise that outsourcing CFO services has become a “secret weapon” for many successful global startups – it combines high-level financial guidance with cost-efficiency.