Financial leadership can make or break a startup. Many founders are experts in product and innovation but lack deep finance experience – and this gap shows in the failure statistics.

Outsourced CFO services have emerged as a smart solution, giving startups access to seasoned financial leadership at a fraction of the cost of a full-time CFO. In other words, a part-time or fractional CFO can provide high-level guidance on demand, helping young companies navigate growth without the hefty overhead.

This article explores why strong financial leadership is vital for startups, the benefits of CFO outsourcing, how to choose the right provider, common pricing models, and highlights ERB – a top-tier provider of outsourced CFO services specializing in early and growth-stage startups.

Outsourced CFO for Startups: Why Financial Leadership Matters

Startups operate in a high-stakes environment where financial missteps can quickly derail progress. Early on, basic bookkeeping might suffice, but as a company scales, the need for strategic financial oversight grows.

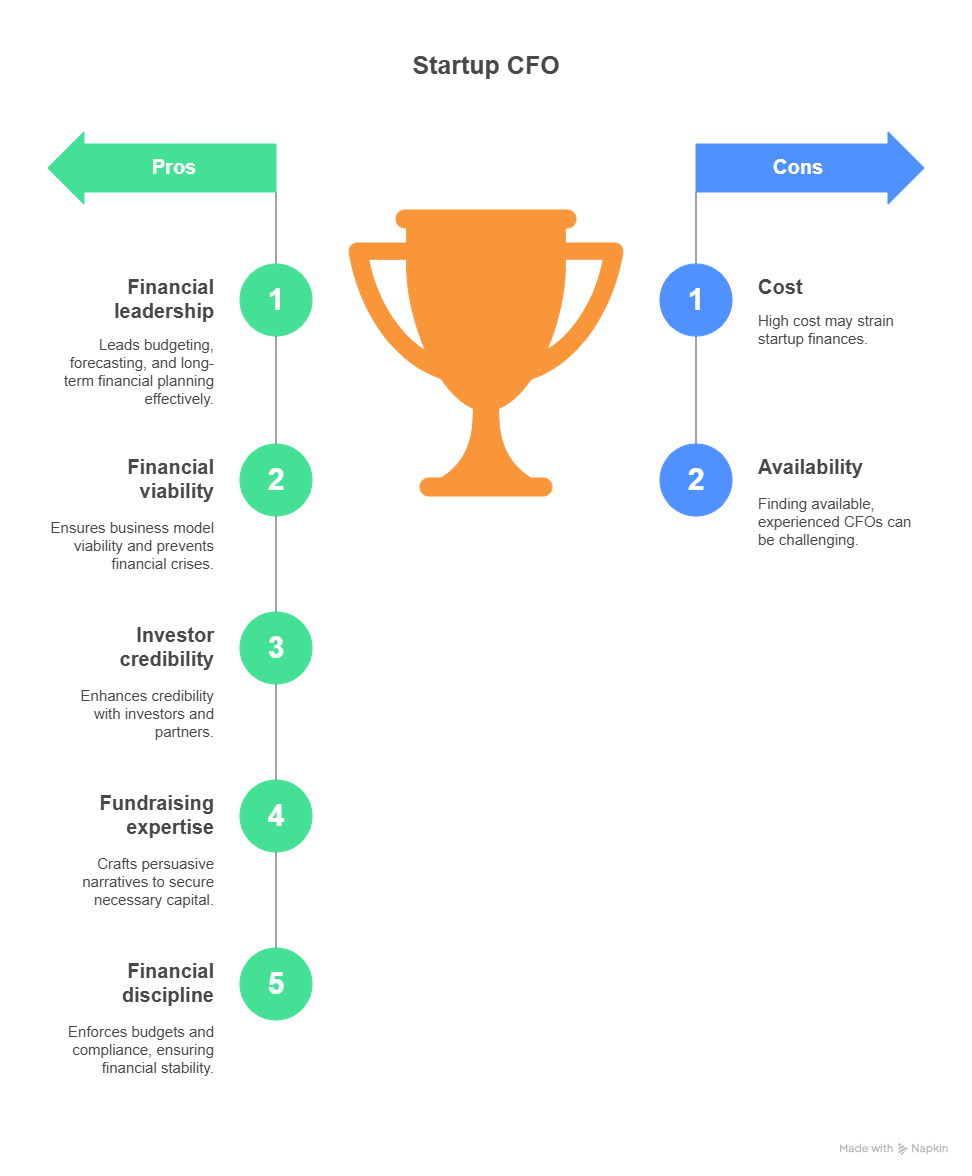

- A Chief Financial Officer (CFO) does far more than track expenses – they lead budgeting, forecasting, cash flow management, and long-term financial planning.

- In a startup, a CFO’s guidance helps ensure the business model is financially viable and the company never loses sight of its runway. This kind of forward-looking financial strategy is essential to prevent the dreaded “run out of money” scenario.

- An experienced CFO also adds credibility with investors and partners, sending a signal that the startup is managing its finances responsibly.

- Crucially, CFOs can spearhead fundraising efforts – leveraging their networks and crafting persuasive financial narratives to help startups raise the capital they need to grow. They instill financial discipline (e.g. enforcing budgets and compliance with accounting standards) from day one, which keeps the company on solid footing and avoids costly mistakes.

Benefits of CFO Outsourcing for Startups

Outsourcing the CFO role offers startups several key advantages, combining high-level expertise with cost-efficiency and flexibility. By engaging an outsourced CFO, a startup gains the strategic financial skills it needs without the full-time cost, freeing up budget for other growth priorities. The arrangement is highly flexible – you pay for a few days or hours of CFO time as required, rather than a six-figure salary – which is ideal for lean startups. Founders also benefit by offloading complex financial management to an expert, allowing them to focus on product development, sales and strategic growth instead of spreadsheets. Below are some of the most important benefits of CFO outsourcing for early-stage companies:

Cost Efficiency: Hiring a fractional CFO is typically 30–50% cheaper than bringing on a full-time CFO when you factor in salary, bonuses, and benefits. Startups conserve cash by paying only for the level of financial guidance they need, whether it’s a few hours a week or a short-term project. This low-overhead model means you get CFO-level insights without straining your burn rate.

High-Caliber Expertise: Outsourced CFO firms give you access to seasoned financial talent with extensive experience in guiding businesses. You tap into CFOs who have navigated funding rounds, managed budgets, and optimized finances for other companies. This expertise can immediately elevate your financial strategy and processes. It’s like having a Fortune 500 finance veteran on your team, on-demand.

Strategic Focus: With an outsourced CFO handling the financial planning and analysis, startup founders and teams can focus on their core business. The CFO will produce forecasts, monitor cash flow, and advise on strategy, so you spend less time in the weeds of accounting. This enables the leadership team to concentrate on product, market growth, and innovation while still maintaining sound financial oversight.

Flexibility & Scalability: CFO outsourcing is highly flexible – services can scale up or down as your needs change. In the early stage, you might use a CFO consultant sparingly, then ramp up engagement during a fundraising push or a major project. You’re not locked into a long-term hire, so the level of support adapts to your company’s size and stage. This agility also means you can access a broader skill set (e.g. bring in specialists for certain tasks) through the CFO firm as needed.

How to Choose an Outsourced CFO Provider

Not all CFO outsourcing companies are the same, so it’s important to evaluate potential providers carefully. When choosing a CFO outsourcing provider for your startup, keep the following criteria in mind:

- Industry Experience & Track Record: Look for providers that have a strong track record with startups, especially in your industry or business model. An outsourced CFO who understands the nuances of SaaS vs. e-commerce vs. biotech, for example, will add more immediate value. Check the firm’s credentials – many top outsourced CFOs are CPAs or MBAs with 8–10+ years of experience in finance. Don’t hesitate to ask for client references or case studies of similar early-stage companies they’ve helped.

- Scalability of Services: Ensure the provider can scale with you as you grow. In practice, this means they should offer a range of services (bookkeeping, controller services, FP&A, tax compliance, etc.) and be able to increase support when you have a busy period. A good outsourcing firm will have a team of finance professionals, not just one person, so they can allocate more resources or specific expertise when needed.

- Technological Tools & Expertise: The best outsourced CFOs leverage modern financial tools to service clients. Seek a provider proficient in your accounting software (or ready to help you migrate to one), and skilled in financial planning & analysis (FP&A) tools, dashboard reporting, and other tech that provides real-time insights. Strong technical expertise ensures you’ll get efficient processes and transparent reporting. For example, your outsourced CFO should be able to set up KPI dashboards or cash flow forecasting models that you can review anytime.

- Communication and Culture Fit: Communication is critical when working with an external CFO. During initial discussions, gauge whether they explain financial concepts clearly and listen to your goals. A great outsourced CFO should act like a partner on your leadership team – that means being responsive to questions, aligning with your company’s values, and meshing with your working style. Choose someone you feel comfortable collaborating with, especially during high-pressure decisions.

- Pricing and Engagement Model: Make sure the provider’s pricing structure aligns with your budget and needs (more on common pricing models in the next section). Some firms require a monthly minimum retainer, while others offer à la carte hourly services. Clarify what services are included and how they bill for extra projects. Transparency here will help you avoid surprises. Also, discuss the onboarding process – a good firm should have a plan to get up to speed on your finances quickly and start adding value within the first few weeks.

By weighing the above factors, you can confidently select an outsourced CFO partner who is well-equipped to guide your startup’s financial journey.

CFO Outsourcing Pricing Models for Startups

How much does an outsourced CFO cost? The answer depends on the engagement model. Fortunately, outsourced CFO arrangements are flexible, and you can choose a pricing model that fits your startup’s budget and scope of needs. Here are the common CFO outsourcing pricing models and how they work:

Hourly Rates: You pay only for the time the CFO actually works, typically billed hourly. Rates can range from about $150 to $300+ per hour for experienced fractional CFOs. This model is great for occasional advisory or analysis work – for example, a few hours a week reviewing financial reports or coaching the founder on investor pitch financials. It provides maximum flexibility, though costs can add up if you require many hours during a busy period.

Monthly Retainer: You pay a fixed fee each month for a defined scope of CFO services. Early-stage startups might see retainer packages anywhere from a few thousand dollars up to around $10K per month, depending on complexity. The retainer model gives you consistent access to your CFO (say, a certain number of days or deliverables per month). It’s predictable for budgeting and ensures your outsourced CFO is continually engaged with your business. Many providers bundle bookkeeping or controller services with CFO oversight in retainer plans for a comprehensive solution.

Project-Based Fees: For one-off strategic projects, a project fee may be negotiated. For instance, you might bring in an outsourced CFO to lead a fundraising round preparation, implement a new accounting system, or handle due diligence for an acquisition, all for a pre-agreed flat price. This approach works well when you have a clearly defined project with a start and end. It allows you to tap high-end expertise just for that initiative.

Performance or Equity-Based: Less commonly, some CFO outsourcing arrangements tie compensation to results. In a performance-based model, a CFO firm might charge a percentage of cost savings or improvements they achieve (for example, a cut of expense reductions identified). In other cases – typically with very cash-strapped startups – a fractional CFO might accept equity as part of their compensation, aligning their reward to the startup’s success. These models can incentivize the CFO to deliver strong outcomes, though they are usually coupled with one of the above base fee structures as well.

Overall, startups should choose a pricing model that provides the needed support while staying within budget. Many young companies start with a small hourly or project engagement and then transition to a retainer as their needs expand.

Remember, even at a few thousand dollars per month, an outsourced CFO can be a bargain compared to the fully-loaded cost of a senior full-time hire, which might easily exceed $200K/year. By right-sizing the engagement, you ensure cost-efficiency while getting the financial guidance your startup requires.

ERB: A Top-Tier Outsourced CFO Partner for Startups

ERB stands out as a leader with nearly 30 years of startup financial leadership under its belt.

ERB has a large team across U.S. (New York and California), and the UK, allowing it to guide companies from inception through international expansion. This depth of experience means ERB’s team has seen virtually every financial challenge a startup might face – and knows how to navigate them with best practices. ERB’s strengths align perfectly with startup needs: The firm provides a 360° finance solution, handling everything from day-to-day bookkeeping and payroll to high-level CFO strategy. In particular, ERB is known for excellence in Financial Planning & Analysis (FP&A) – our consultants build robust financial models, budgets, and forecasts that help startup founders make informed decisions and impress investors. Additionally, ERB has unique expertise in global expansion and compliance. With offices on multiple continents, We seamlessly handle cross-border financial operations – from setting up US subsidiaries to ensuring compliance with international accounting standards and tax laws. This is a huge benefit for startups expanding from one country to another, as ERB ensures nothing falls through the cracks financially.