Qualified Small Business Stock (QSBS) presents one of the most powerful tax incentives available to early-stage investors, startup founders, and employees. Designed to encourage investment in innovative U.S.-based small businesses, QSBS provides significant tax exclusions on capital gains potentially allowing investors to eliminate up to 100% of federal taxes on qualifying stock sales.

But understanding the fine print eligibility, holding periods, limitations, and exceptions is key to unlocking its full benefits.

What Is QSBS?

Qualified Small Business Stock refers to shares issued by an eligible domestic C corporation that meets specific asset and operational requirements under Section 1202 of the Internal Revenue Code (IRC). The goal: stimulate growth in small businesses by rewarding long-term investors with substantial tax relief.

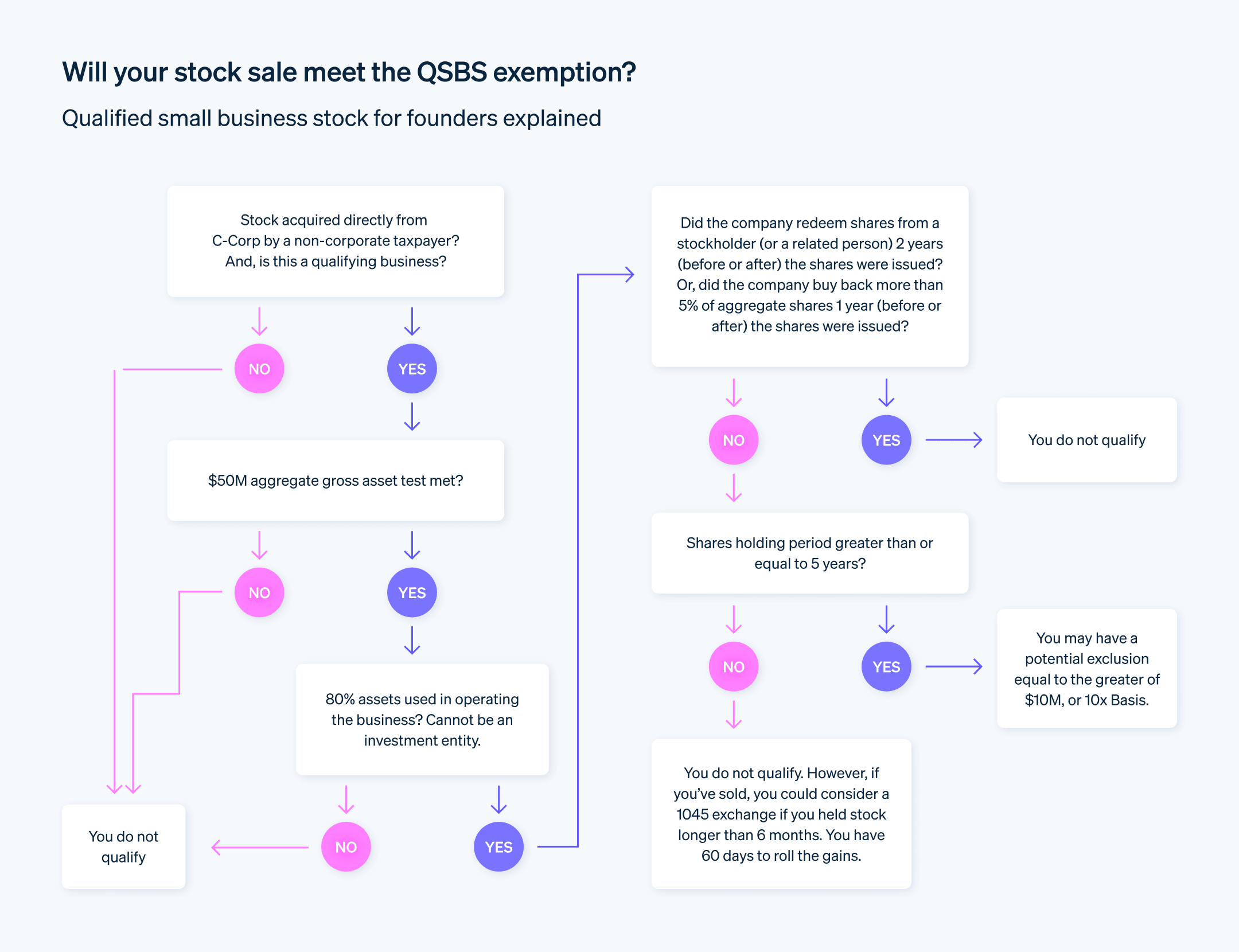

To qualify as a Qualified Small Business (QSB):

- The company must be a C corporation.

- Its gross assets must not exceed $50 million at the time of and immediately after the issuance of stock.

- At least 80% of its assets must be used in active business operations within a qualified industry (e.g., tech, retail, manufacturing).

Industries such as finance, hospitality, personal services, and mining are excluded from QSBS eligibility.

Who Can Benefit from QSBS?

Only non-corporate investors individuals, trusts, and certain pass-through entities, are eligible for QSBS tax treatment. Shares must be acquired directly from the issuing corporation (not via secondary market transactions), and the purchase must be made using cash, property, or services.

Additionally:

- The investor must hold the stock for at least five years to claim the full exclusion.

- Stock must have been issued after August 10, 1993.

- QSBS benefits apply only if the company qualifies both at the time of issuance and during substantially all of the holding period.

Key Tax Benefits of QSBS

QSBS allows qualified investors to exclude a percentage of capital gains from federal taxation upon sale. The amount excluded depends on when the stock was acquired:

Acquisition Date | Capital Gains Exclusion | AMT & NII Tax Treatment |

After Sept. 27, 2010 | 100% | Fully exempt from AMT and NII tax |

Feb. 18, 2009 – Sept. 27, 2010 | 75% | 7% of excluded gain subject to AMT |

Aug. 11, 1993 – Feb. 17, 2009 | 50% | 7% of excluded gain subject to AMT |

In all cases, the remaining taxable portion (if any) is subject to a 28% capital gains rate, plus the 3.8% Net Investment Income Tax (NIIT) where applicable.

Exclusion Limits

Section 1202 also limits the total gain eligible for exclusion. Investors may exclude the greater of:

- $10 million in gains per issuing company (lifetime), or

- 10× the adjusted basis of the QSBS sold during the year.

These limits apply per taxpayer, per company, and may be applied across multiple companies, making QSBS especially advantageous for angel investors and serial entrepreneurs.

What If You Sell QSBS Before 5 Years?

Selling QSBS before the five-year holding period doesn’t disqualify you entirely. Section 1045 of the IRC allows for a tax-deferred rollover: if you reinvest the proceeds in another QSBS within 60 days, you may defer recognizing the gain.

This provision is particularly helpful for investors needing to reallocate their capital or exit an investment early without losing the potential tax advantage.

Real-World Example

Imagine an investor acquires QSBS in a startup on October 1, 2015, for $100,000 and sells it for $500,000 in late 2025. Because the holding period exceeds five years and the shares were purchased after Sept. 27, 2010, the $400,000 gain is entirely excluded from federal tax.

Now suppose the same investor acquired QSBS in February 2009 and sold in 2014. Only 50% of the gain would be excluded, and part of it could still be subject to the alternative minimum tax.

Additional Use Cases: Compensation & Growth

Startups often use QSBS strategically:

- Compensation: Early-stage companies may issue QSBS to employees as part of equity packages when cash flow is tight.

- Retention: Offering stock with tax advantages encourages employees to stay and grow with the business.

- Capital Raising: QSBS makes investments more attractive to angel and seed-stage investors.

Disqualifiers to Watch Out For

You may lose eligibility for QSBS tax benefits if:

- The company becomes an S corporation.

- The business fails to meet the 80% “active business” use-of-assets test.

- The shares were not acquired directly from the company.

- You sell before five years and don’t reinvest under Section 1045.

- You’re a corporation (QSBS benefits apply only to non-corporate taxpayers).

Bottom Line: Why QSBS Matters

QSBS is a powerful tax-planning tool for individuals investing in small, high-growth companies. With the potential to exclude up to 100% of capital gains, and additional benefits such as AMT and NIIT relief, Section 1202 rewards long-term investors who support innovation and entrepreneurship.

However, navigating the complexities of eligibility, timing, and structuring requires careful attention. Investors and founders alike should consult with a tax advisor or legal expert to ensure compliance and maximize the benefit.