How to prepare for seed funding due diligence

Understanding the Importance of Due Diligence Due diligence is an investor’s detailed examination

Understanding the Importance of Due Diligence Due diligence is an investor’s detailed examination

As a startup founder, you may want to offer stock options to employees

Venture Debt is a financing mechanism used primarily for early-stage ventures that have

Launching a startup can be overwhelming with all its responsibilities, but one of

As companies continue to grow, finance becomes a much more difficult aspect of

Starting a new venture in the early stage can be an exhilarating adventure

As a startup requires significant attention to detail and rapid execution in each

Tax compliance and planning for a new enterprise that has received capital through

While payroll management has always been an ongoing activity, in 2026, payroll management

Going public in the United States is a transformative step for any startup.

Financial management has always been a cornerstone of startup success – especially as

As AI becomes deeply integrated into business operations and decision-making, the need for

In periods of rapid growth, startups face a financial balancing act: how to

Launching a startup in the United States as a foreign founder comes with

Every startup – including those in the fintech sector – needs to keep

Startup equity instruments like stock options, SAFEs, and convertible notes come with complex

RealPage, a leading property management software company, has officially acquired Livble – a

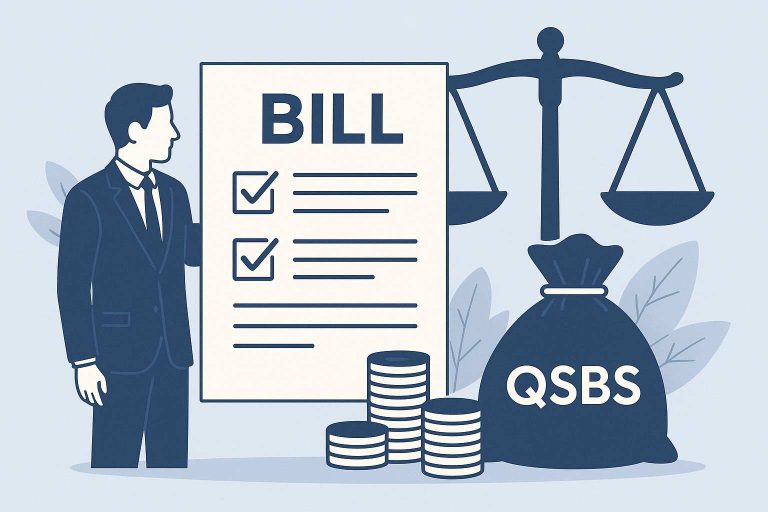

On July 4, 2025, President Trump signed into law the One Big Beautiful

Qualified Small Business Stock (QSBS) presents one of the most powerful tax incentives

For 30 years, ERB has been a leader in providing financial services to

For consultation with our experts, leave details