Expanding internationally often means choosing the right U.S. state for your C-corporation. Delaware, California and New York each have unique rules, costs, and benefits. Below, we outline the incorporation process in each state (steps, timing, fees), and then compare their pros and cons for startups. We focus on C‑corporations and cover key post-incorporation steps like obtaining an EIN, opening a U.S. bank account, setting up payroll, and leveraging outsourced CFO/bookkeeping services.

Delaware: Steps and Startup-Friendly Environment

In Delaware, forming a C-corp is straightforward. You pick a unique company name and a registered agent (an in-state representative). Then you file a Certificate of Incorporation (with details like number of shares, par value, directors, etc.) with the Delaware Division of Corporations. Standard processing online takes only a few business days, and same-day or even 2–3-hour expedited filing is available for an extra fee.

In Delaware, forming a C-corp is straightforward. You pick a unique company name and a registered agent (an in-state representative). Then you file a Certificate of Incorporation (with details like number of shares, par value, directors, etc.) with the Delaware Division of Corporations. Standard processing online takes only a few business days, and same-day or even 2–3-hour expedited filing is available for an extra fee.

Pros (Startups): Delaware is known as the most business‑friendly state. It has a highly respected Court of Chancery that specializes in corporate law, and one of the most flexible, predictable corporate law codes in the U.S.. Investors (VCs, accelerators) often prefer Delaware C‑corps for familiarity and ease of structuring equity. Delaware does not levy state corporate income tax on companies that do no business there (only a franchise tax). This can lower tax burdens for startups not physically operating in Delaware. Formation costs are modest (roughly $100–$200 filing fee), and ongoing maintenance is manageable (a $50 annual report fee plus a franchise tax starting at $175).

Cons (Startups): If your business will actually operate in California, New York or other states, a Delaware corp will still need to “foreign qualify” in each such state (register there too), incurring extra filing fees and paperwork. Delaware’s annual franchise tax can also be steep for corporations with many authorized shares (up to $200,000 for large companies). And while Delaware offers privacy (no need to publicly list owners/officers in the formation documents), some view this anonymity negatively as “hiding”. Overall, Delaware is often best for startups seeking venture investment and planning for high growth or an eventual exit (IPO/acquisition). Small businesses with purely local operations may find less benefit.

California: Steps and Local Advantages

If your team will be based in California (or you want proximity to Silicon Valley investors), consider incorporating in California. To form a California C-corp, you file Articles of Incorporation with the California Secretary of State. You’ll need a corporate name that complies with state rules and the names of at least one director (in California, corp with >3 shareholders must have at least 3 directors). After filing (online or by mail), you must within 90 days submit an Initial Statement of Information listing the company’s address and officers/directors. Expect the Secretary of State’s processing to take several weeks – typically 4–8 weeks by mail (online filing is faster). You can pay extra for expedited service, but even filings “same day” cost additional fee.

If your team will be based in California (or you want proximity to Silicon Valley investors), consider incorporating in California. To form a California C-corp, you file Articles of Incorporation with the California Secretary of State. You’ll need a corporate name that complies with state rules and the names of at least one director (in California, corp with >3 shareholders must have at least 3 directors). After filing (online or by mail), you must within 90 days submit an Initial Statement of Information listing the company’s address and officers/directors. Expect the Secretary of State’s processing to take several weeks – typically 4–8 weeks by mail (online filing is faster). You can pay extra for expedited service, but even filings “same day” cost additional fee.

Pros (Startups): Incorporating in California can simplify compliance if you’ll operate there. You avoid foreign-qualifying your business in the state, and dealing with two sets of state taxes and fees. A California corporation can lend credibility if you plan to sell or hire locally – customers and partners see a “Local CA company” as committed to the market. California law also provides strong protections for shareholders (e.g. robust minority shareholder rights). And of course, you’ll be in the center of U.S. tech investment and talent: Silicon Valley and the Bay Area offer unparalleled access to venture capital and a startup ecosystem.

Cons (Startups): California is one of the most expensive and regulated states. All corporations there pay an $800 minimum franchise tax every year, regardless of income. There’s also an annual Statement of Information (usually $25 fee) to file, and ongoing state corporate income tax if you’re headquartered in California. California’s regulatory and bureaucratic requirements are broad (labor laws, environmental rules, privacy regulations, etc.), so compliance is more burdensome. Privacy is limited – you must disclose your officers and directors in public filings. Operating costs (wages, rent) tend to be higher too. In short, California suits startups with substantial California operations or those that value its market and networks, but the high fixed costs can be a drag on very early-stage companies.

New York: Steps and Local Strengths

A New York C-corp forms similarly: you file a Certificate of Incorporation with the New York Department of State (DOS). The filing fee is $125. Unlike an LLC, New York corporations do not have a cumbersome publication requirement (that applies only to LLCs). After incorporation, you must file a Biennial Statement every two years with DOS (fee $9) to report your CEO’s name and corporate address. New York processes filings quickly; you can even pay an extra fee for same-day or 2‑hour turnaround.

A New York C-corp forms similarly: you file a Certificate of Incorporation with the New York Department of State (DOS). The filing fee is $125. Unlike an LLC, New York corporations do not have a cumbersome publication requirement (that applies only to LLCs). After incorporation, you must file a Biennial Statement every two years with DOS (fee $9) to report your CEO’s name and corporate address. New York processes filings quickly; you can even pay an extra fee for same-day or 2‑hour turnaround.

Pros (Startups): New York offers a stable legal environment and business protections. Its courts are known for fair contract enforcement and a strong business-judgment rule, giving directors confidence in decision-making. New York also has a mature financial ecosystem (Wall Street, VC, accelerators) and specialized courts (Commercial Division) for business disputes. If your market is in NY/NJ or you operate in sectors like finance or media, being a New York corporation can make sense. The state has targeted tax incentives (e.g. R&D credits, emerging tech credits) to help startups, which can offset some of the higher tax burden.

Cons (Startups): New York’s costs are higher than Delaware’s or many other states. The minimum $125 filing fee and biennial $9 report are small, but New York also imposes its own corporate franchise and income taxes on businesses located there. If you incorporate elsewhere but do business in New York, you must register as a foreign corp and pay NY fees (plus NY taxes). In general, New York is competitive but has higher taxes and regulation compared to states like Delaware or Texas. Startups with no real New York presence often skip NY in favor of cheaper states.

| Feature / State | Delaware | California | New York |

|---|---|---|---|

| Filing Process | File Certificate of Incorporation with DE Div. of Corps. Fast online (few days). Registered agent required. | File Articles of Incorporation with CA Secretary of State. Requires name reservation, directors, etc. Statement of Info due in 90 days. Standard mail filings ~4–8+ weeks. | File Certificate of Incorporation with NY DOS ($125 fee). Can expedite same-day. Biennial $9 report due every 2 yrs. |

| Initial Fees | ~$100 (up to 1,500 shares) + agent fee. | ~$100 filing fee (Articles) plus $25 SI fee. | $125 filing fee. |

| Annual/Recurring Fees | Franchise tax (min ~$175) plus $50 annual report. | $800 minimum franchise tax per year. Annual Statement $25. | Biennial report $9 every 2 years. State corp tax applies. |

| Corporate Law & Courts | Very flexible, predictable corporate law (Chancery Court). | California law more protective of employees; no specialized business court. | Strong business courts (NY Supreme Commercial Division), well‑developed laws. |

| Privacy | Formation does not require listing owners/officers. | Must disclose officers/directors in public filings. | Biennial statement lists CEO name & address. |

| Timeline (typical) | Fast. Online filings in days; expedited (same-day, 2hr) available. | Slow if by mail (~4–8+ weeks); online limited. Expedited available. | Quick: can file online same/next day (with fees). |

| Investor Appeal | Very high (preferred by VCs, IPOs). | Moderate (regional; well-known for tech). | Moderate (strong finance presence; not a common VC-preferred domicile). |

| Startups Often Choose If… | Seeking venture funding, IPO, or operating nationally. | Business is physically in CA or key CA market; seeking West Coast VC. | Business is in NY/finance/media; needing East Coast network and customers. |

| Major Drawbacks | Franchise tax can be high; requires foreign qualification if operating elsewhere. | High taxes and fees ($800 min), heavy regulation, higher operating costs. | High state taxes; must register as foreign if incorporated elsewhere. |

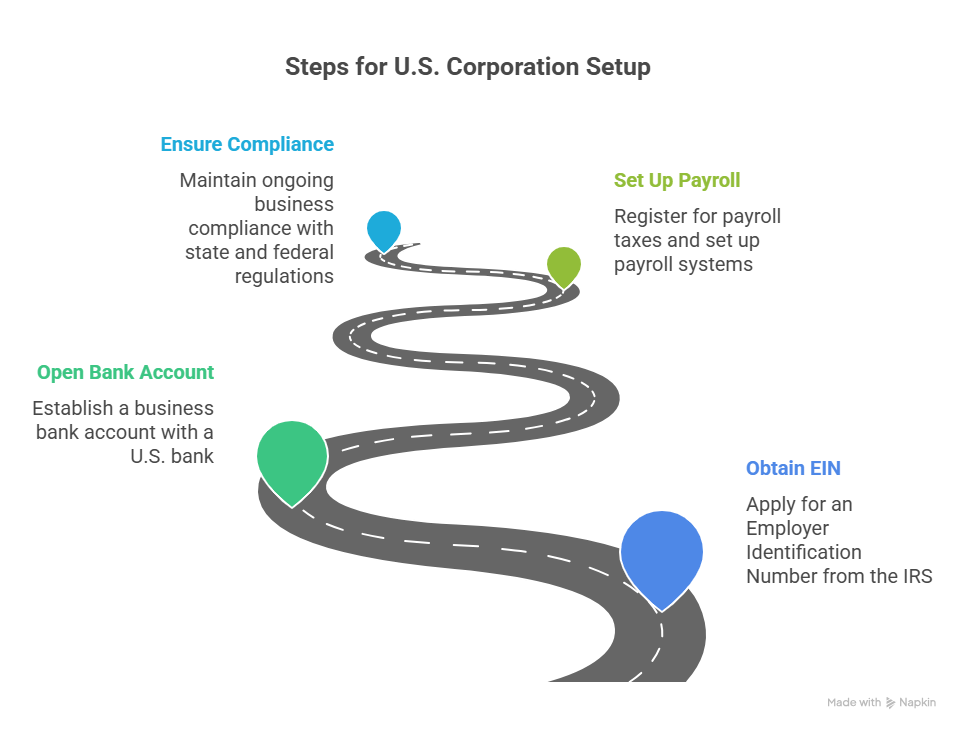

U.S. Startup Essentials: EIN, Bank Account, and Payroll

Once the corporation is formed, you’ll need to handle practical steps:

- Obtain an EIN. Every U.S. corporation needs an Employer Identification Number (EIN) from the IRS. This is used for tax filings, hiring employees, opening bank accounts, etc. You can apply for an EIN online (form SS-4) for free on the IRS website. In fact, the IRS will issue an EIN immediately if the application is submitted by a responsible party with a U.S. SSN/ITIN; if not, it can take a couple of weeks.

- Open a U.S. business bank account. After incorporation and EIN, the next step is usually a company bank account in the state of incorporation. Banks vary in how they handle non-U.S. owners. Officially no law forbids foreign businesses from U.S. accounts, but in practice banks have their own policies. Many non‑U.S. startups find it easiest to open accounts with major banks like Wells Fargo, which is known to work with foreign business owners even without U.S. IDs. Typically, after you provide company docs (incorporation certificate, EIN letter, etc.), opening the account can take a few weeks; banks often require in‑person visits for verification. A tipsheet from Commerce Dept. notes it can take about three weeks and may involve visiting a branch after receiving your EIN. Many startups also consider online/Electronic Money banks (Wise, Mercury, Relay, etc.), but those have changing policies for foreign founders.

- Set up payroll and tax registrations. If you plan to hire employees, you must register for payroll taxes. First register with the IRS (your EIN covers federal withholding, Social Security/Medicare taxes). Next, register with the state(s) where you pay wages: for each state (including California or New York if you have employees there), you must set up payroll withholding accounts, unemployment insurance accounts, etc.. California and New York each have their own withholding and unemployment tax rules, so you would register with the California EDD or New York DOL as needed. Many founders use payroll service providers (like ADP, Gusto, or payroll bureaus) to handle withholding and filings. Note that states like California and New York require regular payroll filings (e.g. CA requires at least bi-monthly paychecks). In all cases, it’s advisable to work with an accountant or payroll specialist, especially when you’re unfamiliar with U.S. payroll tax law.

- Ongoing business compliance. After incorporation, remember other obligations: e.g. California corporations file an annual Statement of Information (around every 12 months), and Delaware or New York corps file annual or biennial reports. Don’t forget to pay your state franchise taxes (DE March 1, CA April 15 for the $800 tax, NY March 15) and any city taxes if applicable (e.g. New York City business taxes).

Throughout these steps, many startups find it useful to work with U.S.-based advisors or services. For example, a registered agent service handles official mail, and online platforms (like Stripe Atlas) can assist with filing EIN and forming the company. But even after formation, managing all compliance and finances can be overwhelming for a founder.

Outsourced CFO and Bookkeeping Services

To streamline U.S. expansion, startups often outsource financial operations. A fractional or outsourced CFO provides high-level financial expertise on demand (without full‑time salary). According to industry sources, startups commonly turn to outsourced CFOs for planning and reporting. Benefits include cost savings (you pay only for needed time, not a full-time $200K+ salary) and expert advice (financial projections, fundraising support, budgeting, etc.). An experienced fractional CFO can help build your financial model, prepare investor decks, and manage fundraising meetings. (For example, one report notes that an outsourced CFO can “make fundraising go more smoothly” by preparing docs and introductions.)

Similarly, outsourced bookkeeping and accounting can save startups both time and money. Rather than hiring a full‑time bookkeeper (with salary, benefits, office space, etc.), companies use third-party services. Experts estimate that outsourcing bookkeeping can cut costs by 40–60% compared to in-house staff. It frees founders to focus on the business, while ensuring your books are accurate and up‑to‑date. Outsourced accounting firms typically use cloud-based systems so you can access your financials anywhere. They also handle routine tasks (reconciling accounts, tax prep) and scale services as you grow. In short, outsourced finance/accounting firms provide professional reports and tax compliance at a fraction of a full‑time team’s cost. This is especially valuable for international founders who need U.S. bookkeeping done to IRS standards and local GAAP.

Payroll services can also be outsourced: many providers will run payroll, file taxes, and even handle employee benefits. This is outside the scope of formation, but it’s worth noting that after you have EIN and bank account, you can engage a payroll service to automate hiring and payslips.

Choosing the Right Partner: ERB

Building a U.S. C-corp as a foreign startup is complex, but you don’t have to go it alone. Working with specialists can save time and ensure compliance. ERB (Entrepreneurial Results & Bridge) is one such partner: we offer outsourced financial, accounting, payroll, and CFO support tailored to high-growth startups. Our team acts as your part-time CFO and accounting department, so you get expert U.S. financial guidance without the full-time overhead. We handle bookkeeping, payroll filings, tax compliance, and investor reporting – all aligned with U.S. standards. Startups we work with typically save costs (vs hiring internally) and gain faster insights. For example, outsourcing bookkeeping can save 40–60% of costs, while an outsourced CFO provides strategic finance help on demand.

In conclusion, many startups opt for Delaware when they need a scalable, investor‑friendly C-corp (especially if raising venture funding). California makes sense if your team and market are there (but be prepared for higher fees and the $800 minimum tax). New York suits companies tied to its financial or media sectors. After choosing a state and incorporating, remember to get your EIN, open a bank account, set up payroll and tax registrations, and maintain annual filings. Throughout, ERB can be a trusted advisor – we provide the outsourced CFO and accounting support that helps international founders establish and grow their U.S. operations smoothly.

Sources: Authoritative state corp. laws and guides were used (see citations). We cited Delaware’s official site and Stripe for process and taxes, California Secretary of State resources for filings, New York DOS for filings and fees. Other sources include IRS (for EIN), U.S. Commerce (for banking), and finance publications (on payroll and outsourced CFO/bookkeeping). These informed the above comparison and guidance.