Table of Contents

Sales Tax in 2025: Key Updates and What You Need to Know

Owner compliance with sales tax rules has never been more challenging. Changes in rates, nexus standards, and a digital economy make for a lot of information for businesses to manage and keep up with in 2025.

2025 tax rates and adjustments

Seeing sales tax implications in changed landscape is essential to keeping the business compliant. Below are the most critical updates and trends impacting businesses in 2025.

Updated Tax Rates

Several states have revised their sales tax rates:

- Louisiana: Raised from 4.45% to 5%.

- California: Adjusted to 7.25%.

Make sure you’re always up to date with the tax changes in every state where you do business.

Evolving Nexus Requirements

Economic nexus laws, based on sale volume or revenue instead of physical presence, keep expanding.

In 2025, several states revised their thresholds.

Alaska has removed its 200 transaction threshold for remote sellers (Alaska Department of Revenue).

Digital economy impact

States are modifying tax codes to encompass more digital sales:

- More types of a digital transaction such as In-app purchases, digital books, and games will be taxed in additional states.

- Additionally, streaming services will potentially have new obligations.

Online Marketplaces have expanded duty.

If you sell digital products; review the tax code in the states your customers live in.

New Delivery Fees

States have passage retail delivery fees:

Current: Colorado, Minnesota.

States considering the delivery fee: Nebraska, New York, Washington.

There may be a need to change pricing and shipping practices; stay knowledgeable to remain compliant!

The Broadening of Sales Tax Holidays

Tax free shopping is becoming more common.

Ohio has expanded and broadened its back-to-school holiday, allowing for more products and merchants than ever!

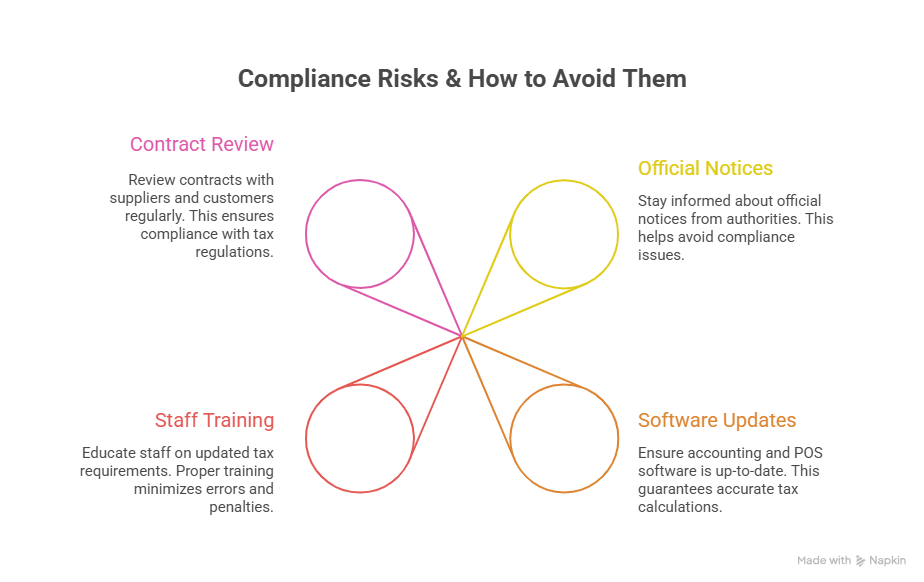

Compliance Risks & How to Avoid Them

Failing to comply will place your business at risk of fines, audits, or reputational damage. Protect yourself by doing some simple things:

– Be aware of any official notices from your state taxing authority.

– Make sure your accounting and point of sale software is current.

– Train your staff in any new or updated requirements.

– Review any contracts with your suppliers and customers.

Refer to your tax experts on a regular basis.

Sales tax compliance in 2025 will require vigilance and adaptability. Whether you change to new state rates, comply with new obligations regarding digital sales or simply get used to the new delivery fees- being ahead of the game makes for a successful business.

If you need support adapting to sales tax changes, contact ERB today to speak with an expert who understands your business.

The Fundamentals of Sales Tax in the US SaaS Market

We often hear about the complexities of US sales tax, and unfortunately, if you’re a SaaS (software as a service) business owner, the odds aren’t necessarily stacked in your favor. Of course, this is if you plan on tackling your sales tax obligations by yourself. Fortunately, sales tax for SaaS doesn’t have to be daunting, at least not when you’ve got experts to show you the ropes! In this all-you-can-read buffet, we’re touching on all the most important aspects of US sales tax and how it applies to your business.

An Overview of SaaS Sales Tax in the US

In a nutshell, albeit hard to crack, sales tax is the tax applied to selling goods and services. But here’s where things get tricky: SaaS sales tax is about as complicated as tax gets. Why? Well, this has mostly to do with its classification. Is it a service, a product, or software? The complexities arise from these classifications because each state in the USA attempts to adapt its tax legislation to the evolving digital landscape. But we’ll get to that in a second. For now, Sales Tax for SaaS refers to the following:

As a SaaS business, it is your responsibility to ensure you know which states require you to pay sales tax. This tax obligation is referred to as a “nexus.” However, as mentioned above, each state has its own sales tax laws and rates in the United States, which can be confusing for businesses operating across state lines or just starting out.

Before continuing down the SaaS sales tax rabbit hole, it’s important to first establish what it is NOT. Ergo, it’s not use tax and here’s the difference.

The Difference Between Sales Tax And Use Tax

Both sales tax and use tax are known as ‘indirect’ taxation. The critical difference, however, is that sales tax is a single-stage tax. This means that sales tax is charged only once at the retail sale to the final consumer. This tax is added to the sale price, making it visible to the consumer at the time of purchase. On the other hand, use tax is generally applied when you use, store, or consume items you bought without paying sales tax, usually from out-of-state vendors.

A practical example:

Suppose you’re a SaaS founder who offers a project management tool to customers in your home state. The customer subscribes to your service for $50 per month. Great! However, you have a sales tax obligation in this state, which means you must collect a 7% sales tax at checkout, making the total cost to the customer $53.50. You then remit the collected sales tax to your state’s tax authority. Voila!

A few days later, you sell the same tool to a customer in a different state where you do not have a sales tax nexus. Okay, now what? This is where use tax plays a role. As you are exempt in that particular state, you do not collect sales tax on the $50 subscription fee. The customer, however, is responsible for reporting and paying a 7% use tax on the $50 to their state, amounting to $3.50.

The Importance of Sales Tax Compliance for SaaS Companies

Now, when it comes to understanding (and navigating) the SaaS sales tax landscape, it’s essential to understand both the consequences and advantages of sales tax compliance.

However, balancing the two is quintessential to mastering your sales tax obligations. How so? Well, focus too much on the consequences, and you’re left with fear, uncertainty, and doubt as the main driving force behind your tax posture, which is both draining and unsustainable.

On the flip side, focus too much on the advantages of healthy compliance, and you may miss critical updates or gaps, leading to exposure. So, to help navigate the landscape, here’s the full map!

The Consequences of Non-Compliance

You’re looking at financial penalties

If you’re required to collect sales tax and you don’t, there is little to no grace, even if you’re a SaaS trying to figure out the ropes. Simply put? Failing to meet your sales

tax obligations (collecting and remitting) can expose your SaaS to fines, interest charges, and state-specific penalties.

There will be legal repercussions

Unfortunately, the consequences of non-compliance go beyond financial penalties. Legal repercussions vary by state but could result in legal action by state tax authorities. Additionally, businesses may face audits and investigations, which can be time-consuming and costly. Lastly, in cases of persistent non-compliance, businesses could face lawsuits and potential business closures.

Non-compliance could lead to operational disruptions

As a scaling SaaS business, you can’t afford operational disruptions due to compliance issues. Addressing compliance issues can divert resources from core business activities and eat at your capacity and resources. Not only does it stunt your growth, but it can put a nasty dent in client loyalty and trust.

Loss of business opportunities

Non-compliance may disqualify your business from certain contracts or partnerships. Potential investors or acquirers may view non-compliance as a red flag, affecting funding and acquisition opportunities. Moreover, customers may choose competitors who demonstrate better compliance and reliability and rightly so!

Although the consequences of non-compliance should be taken seriously, it’s important to note that it’s not all doom and gloom.

The Benefits of Sales Tax Compliance

In a (very) competitive SaaS landscape, everyone is vying for the client’s trust, loyalty, and overall approval. This becomes exponentially easier when you know you aren’t operating with any compliance targets on your back, showing them that your business operates responsibly and transparently.

There will always be some risk when running a business. However, some risks are more important to prioritize and mitigate than others, with sales tax risks at the top of that list. Consistent compliance ensures accurate tax collection and remittance, reducing the risk of financial setbacks arising from non-compliance.

By conquering compliance and implementing robust sales tax compliance processes, SaaS businesses can effectively streamline operations, freeing up resources to focus on core business activities and growth initiatives. This naturally leads to the ability to scale operations, allowing SaaS businesses to expand into new markets confidently without being hindered by tax-related complexities.

Did you know that 75% of companies consider tax compliance a critical factor in choosing a SaaS provider? This is a no-brainer, and compliance with sales tax regulations is a surefire competitive differentiator, especially in industries where trust and reliability are paramount.

Okay, great! You’re confident in WHY you should comply with your sales tax obligations. The next step is HOW, exactly?

Understanding Your Sales Tax Obligations. Hello, Nexus!

As a SaaS business, the chances are incredibly high that you’re selling your service across multiple state lines. Therefore, you must understand which states you have sales tax obligations in and where you do not. This sales tax connection (or obligation) you have in a state is called a “Nexus.”

Nexus: the sufficient presence a SaaS business establishes in a state, triggering the obligation to collect and remit sales tax. For SaaS companies, Nexus can be established through various means, such as having employees, offices, or significant sales activity in a particular state.

Simply put, your Nexus is the invisible string that ties you to that state (and all its accompanying sales tax requirements). However, as a SaaS, determining whether or not you have triggered a Nexus can be especially challenging, considering the varying classifications of a SaaS. But complicated doesn’t negate its importance, so let’s start with the types of Nexus that a SaaS can trigger.

Types of SaaS Nexus: Physical, Economic, and Affiliate

Physical Nexus:

Businesses can trigger a physical nexus based on the literal location of their business and employees (ergo, physical presence). Often, SaaS companies overlook this Nexus as they do not necessarily operate from physical premises. However, there’s much more to the matter. For SaaS in particular, key triggers that activate a physical nexus include:

Economic Nexus:

Economic Nexus for a SaaS business refers to the presence or connection established solely based on economic activity within a state, such as sales revenue or transaction volume, regardless of physical presence. In other words, if a SaaS company exceeds certain thresholds of sales revenue or transactions in a state, it may be deemed to have economic Nexus and thus be required to collect and remit sales tax in that state. Economic nexus laws vary by state and are important for SaaS businesses operating across multiple states.

Affiliate nexus:

An affiliate nexus for a SaaS business typically involves an agreement where the affiliate, such as a website or marketing partner, promotes the SaaS products in exchange for a commission or other compensation. Suppose the affiliate operates where the SaaS business has no physical presence but meets certain criteria. In that case, it can trigger a nexus, requiring the SaaS business to collect and remit sales tax in that state. Affiliate nexus laws vary by state and may include specific thresholds or criteria for determining Nexus. Key triggers include:

Needless to say, there are many ways that your SaaS can trigger a nexus, emphasizing that no business should consider themselves ‘under the radar’ when it comes to monitoring and managing their sales tax obligations. However, before confirming your Nexus, another crucial point to consider is the taxability of your SaaS products and services.

States Generally Exempting SaaS from Sales Tax:

With over 12,000 taxing jurisdictions in the US, it can be difficult for SaaS companies to determine which states they must collect and remit sales tax in. This becomes increasingly challenging as some states consider your SaaS a taxable service, whereas others could exempt you from any obligations. Here’s an overview of what you need to know per state.

If you’re a SaaS – here are the states that tax you!

SaaS State-by-State Sales Tax Cheat Sheet

Alabama: Alabama considers computer software tangible personal property. It generally taxes digital products such as software, movies, music, and e-books but does not currently tax SaaS. The tax threshold: $100,000 in annual sales or 200 separate sales transactions

Alaska: Alaska can be tricky. Simply put, Alaska does not have sales tax on a state level (as it’s part of the NOMAD states) but the local jurisdictions do impose sales tax where in some cases, SaaS might be subject to sales tax

Arizona: SaaS is taxable in Arizona at a state-wide level and local tax rates apply. The tax threshold is $100,000 in annual sales.

Connecticut: SaaS is taxable in Connecticut. SaaS for personal use is taxed at the ful rate, but SaaS for business use is taxed at a lower percentage. The economic sales threshold is $100,000, and the transaction threshold is 200.

Hawaii: SaaS and computer services are subject to taxation in Hawaii. The state’s general excise tax is imposed on all goods and services unless they are specifically exempt from taxation. The economic threshold is $100,000, and the transaction threshold is 200.

Iowa: Taxable at a rate that varies if for personal use. If for business use, then SaaS is exempt. Moreover, sales tax is applicable to the sale of specified digital products and certain digital services. Specified digital products include digital audio works, digital audio-visual works, and digital books. Digital services subject to sales tax include Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS).

Kentucky: As of January 1, 2023, SaaS is recognized as a taxable service (as long as it is delivered into the state).

Maryland: In Maryland, SaaS is taxable. However, SaaS intended for business use is exempt from sales tax. Take note that a number of digital services are exempt, though, and businesses should check in with the Maryland Comptroller’s Office to determine the taxability of their services.

Massachusetts: Both SaaS SaaS and cloud computing are taxable in Massachusetts. Tax is charged regardless of the transfer of ownership. A word for the wise – Massachusetts is one of the states that have taken a firm and clear stance on SaaS taxability.

New Mexico: Yes. Custom and canned software and computer services are taxable. If your business sells SaaS to customers in New Mexico and meets the state’s nexus requirements, you’re obliged to collect and remit GRT on those sales. New Mexico defines both SaaS and cloud computing as services, making them subject to the GRT compliance requirements.

New York: SaaS is taxable in New York.

Ohio: The state of Ohio charges sales tax. However, there is an exemption when SaaS is employed for personal use.

Pennsylvania: Pennsylvania charges sales tax if the user is located within the state.

Rhode Island: All prewritten software, whether vendor-hosted or not, is subject to sales tax on SaaS.

South Carolina: In SC, SaaS is considered a communications service and, therefore, subject to sales tax.

South Dakota: Yes! In SD, electronically delivered software is considered tangible personal property.

Tennessee: Yes, SaaS is taxable in Tennessee. It is subject to sales and uses tax, irrespective of a customer’s method of use, and is taxed at the base rate.

Texas: This can be a tricky one. SaaS is 80% taxable and 20% exempt in Texas, as they are considered part of a data processing service.

Utah: SaaS is subject to sales tax in Utah. The sales tax rate for digital services matches that for tangible personal property at the state level, plus any applicable local sales taxes. The economic nexus threshold is $100,000 in gross sales or 200 separate transactions within the state in the previous or current calendar year.

Vermont: In Vermont, the sales tax laws have evolved to include certain digital services. These services are subject to the standard sales tax rate.

Washington: Yes, you must charge Washington SaaS sales tax on your sales to customers in the state. The economic nexus threshold for taxable transactions is $250,000 or 200 transactions, with filing due dates set for the 20th of the month following the reporting period.

West Virginia: SaaS is considered a taxable service in West Virginia, with an economic sales threshold of $100,000 and a transaction threshold of 200.

SaaS State-by-State Sales Tax Cheat Sheet

| State | SaaS Taxable? | Economic Nexus Threshold | Notes |

|---|---|---|---|

| Alabama | No | $100,000 or 200 transactions | Software is tangible personal property; digital products are taxed, but SaaS is not currently taxed. |

| Alaska | Varies (local) | N/A at state level | No state sales tax (NOMAD), but local jurisdictions may tax SaaS. |

| Arizona | Yes | $100,000 (annual sales) | Taxable statewide; local rates also apply. |

| Connecticut | Yes | $100,000 and 200 transactions | Personal use taxed at full rate; business use taxed at a lower rate. |

| Hawaii | Yes | $100,000 and 200 transactions | General excise tax applies to all goods and services unless specifically exempt. |

| Iowa | Varies | Not specified | Personal use may be taxable; business use exempt. Digital products (audio, AV, books) and some digital services (SaaS/IaaS/PaaS) can be taxable. |

| Kentucky | Yes | Not specified | Recognized as a taxable service when delivered into the state (since Jan 1, 2023). |

| Maryland | Yes (business-use exempt) | Not specified | SaaS is taxable, but business-use SaaS is exempt; several digital services are exempt—check specifics. |

| Massachusetts | Yes | Not specified | SaaS and cloud computing are taxable regardless of transfer of ownership. |

| New Mexico | Yes | Not specified | Custom/canned software and computer services taxed under GRT; SaaS and cloud computing treated as services. |

| New York | Yes | Not specified | SaaS is taxable in New York. |

| Ohio | Varies | Not specified | Sales tax applies; there is an exemption when SaaS is for personal use. |

| Pennsylvania | Yes | Not specified | Sales tax applies if the user is located in the state. |

| Rhode Island | Yes | Not specified | All prewritten (vendor-hosted or not) software is taxable, including SaaS. |

| South Carolina | Yes | Not specified | Considered a communications service; subject to sales tax. |

| South Dakota | Yes | Not specified | Electronically delivered software is treated as tangible personal property. |

| Tennessee | Yes | Not specified | Subject to sales and use tax at the base rate regardless of method of use. |

| Texas | 80% taxable | Not specified | Treated as data processing: 80% taxable, 20% exempt. |

| Utah | Yes | $100,000 or 200 transactions | Tax rate aligns with tangible personal property; local taxes may apply. |

| Vermont | Varies | Not specified | Certain digital services are taxable at the standard rate—confirm whether your SaaS qualifies. |

| Washington | Yes | $250,000 or 200 transactions | Filing due on the 20th of the month following the reporting period. |

| West Virginia | Yes | $100,000 and 200 transactions | SaaS is a taxable service. |

Chapter 4: Sales Tax Registration for SaaS

For startups especially, a few common sales tax registration slip ups are easy to make but easy to avoid. So, if you’re confident that you’re about to trigger a nexus, or if you’re rapidly scaling and want to iron out the sales tax processes before expanding across multiple states, here’s what you need to know.

As soon as you’ve triggered a nexus, you must register in the relevant state and collect sales tax from the buyers there. But unfortunately, registration isn’t as straightforward as a link that reads, ‘Sign me up for sales tax.’ As with everything sales tax related, all states have different requirements and rules regarding the

registration process after you’ve activated your Nexus.

However, although the state-specific registration requirements may differ, there are a few core truths regarding collecting sales tax in the US.

The need for a valid US sales tax permit

You must obtain a valid US sales tax permit to collect sales tax legally. Initiating sales tax collection without a permit could be deemed tax fraud by some states.

Fortunately, many states offer online registration through their Department of Revenue. You’ll receive your sales tax permit number instantly or within ten business days. If you opt for mail-in registration, processing may take 2–4 weeks.

Here’s some standard information you’ll need when registering for a US sales tax permit:

- Your personal contact info

- Your business contact info

- Social Security number (SSN) or Federal Employer Identification Number (FEIN), also known as Employer Identification Number (EIN)

- Business entity (sole proprietor, LLC, S-Corp, etc.

Once you have successfully obtained the required forms and sales tax permits from each tax authority’s online portal to enable lawful sales tax collection, you may have to prioritize any missed tax obligations in the past; you can rectify this by filing for back taxes. Many states offer voluntary disclosure agreements (VDA), providing a means to declare any previously missed taxes without facing severe penalties.

Ultimately, the only way to ace the registration process is to understand the specific state laws and regulations where you’re obligated to register. Fortunately, you don’t have to take on that burden alone; check out our State-by-State Sales Tax Guide Launchpad.

What if you’re exempt? Managing Sales Tax Exemptions and Resale Certificates

As many SaaS businesses could be considered exempt in specific states, it’s important to remember that being exempt doesn’t mean you’re not exposed. All businesses must still manage and monitor their sales tax exemptions and resale certificates.

What are resale certificates, and why do you need them?

Resale certificates, sales tax certificates, reseller permits, or sales tax exemption certificates are state-issued documents that exempt buyers from paying sales tax on purchases from vendors, retailers, or wholesalers. These certificates are essential for ensuring that sales tax is only paid by the final consumer, allowing retailers and resellers to avoid paying sales tax on items they will resell or components that will be part of the final product. These certificates are crucial for SaaS businesses in managing tax obligations and ensuring compliance. For example:

- SaaS providers use these certificates to buy tax-free software or services when they intend to resell them as part of their offerings. The sales tax is collected when the SaaS product is sold to the end user.

- Certain organizations, such as non-profits and those with 501(c)(3) status, can apply for sales tax exemption certificates. This allows them to use SaaS products without paying sales tax, as they are considered exempt final users.

In terms of compliance, managing exemption certificates is an absolute must. Moreover, evidence of this is essential for auditing purposes. SaaS companies must retain and provide these certificates to claim exemptions on purchases. Without them, the SaaS provider and the buyer may face penalties for non-compliance during an audit.

Sales Tax Collection and Remittance

You could absolutely master the entire Nexus and registration process, but there is always one crucial risk factor regarding consistent compliance-the sales tax calculations. As your SaaS begins to scale, your sales tax obligations start to resemble dozens of spinning plates, requiring a masterful balancing act in order to keep them from smashing into pieces.

However, every balancing act has its limit, and as you start to grow, so does your risk of exposure. Given the lack of a standardized rate, one of the most challenging aspects is ensuring you apply the correct rate to each transaction.

While nearly all 50 states levy sales tax, the rates and rules vary by state and local jurisdiction. Additionally, the applicable tax rate can depend on the specific type of product or service you offer.

Common pitfalls when calculating sales tax

Ignoring Local Taxes: Don’t overlook local taxes, which can vary significantly within a state. Ensure your tax calculations include state, county, and city tax rates where applicable.

Outdated Tax Rates: Outdated tax rates can lead to incorrect tax calculations. Regularly update your tax rate tables or automated software to reflect current rates.

Incorrect Nexus Determination: Failing to determine where you have Nexus accurately can result in missed tax obligations or over-collection. Regularly assess your nexus status across all states.

Misclassification of Products and Services: Ensure that your SaaS offerings are correctly classified according to state tax laws. Misclassification can lead to incorrect tax applications.

Right. So what’s the solution?

Don’t panic: let’s recap

We get it – this is usually the point where everything tends to feel a tad (extremely) overwhelming. As a founder, you may feel too overwhelmed to open your SaaS product to the US market or hesitate to scale across state lines. Alternatively, you may feel panic, thinking you may be at risk for exposure and non-compliance.

Fortunately, we’re here to help. Let’s summarize your overall to-do list when managing your sales tax obligations.

Your Sales Tax Survival Checklist

Here’s what you need to do:

- Determine YOUR Nexus: Identify states where you have a physical and economic presence (offices, employees, etc.). Assess if your sales, revenue, or transaction volumes exceed state thresholds. Don’t forget to review affiliate relationships that could establish Nexus in certain states.

- Identify Customer Locations: Map out your customers’ locations and categorize them as B2C or B2B.

- Research State Tax Laws: Review sales tax laws and regulations in each state where you have Nexus.

- Understand Exemptions: Identify states with exemptions or exceptions for SaaS transactions.

- Classify SaaS Products: Ensure your products are correctly classified according to state tax laws.

- Register for Sales Tax Permits: Obtain sales tax permits in states where you have Nexus.

- File Sales Tax Returns: Prepare and submit sales tax returns promptly for each state.

- Maintain Documentation: Keep detailed records of all sales, exemptions, and tax payments. This includes acquiring and managing resale certificates for exempt purchases.

Now, rinse and repeat the process for every nexus state you trigger. Except you’re not a compliance expert; even if you were, monitoring and managing your sales tax exposure is a full-time job. So, rather than have sales tax compliance cost you your resources, time, and peace of mind, we’d like to propose an alternative.